‘Tally Computer Course Note’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Tally Practice Notes’ using the download button.

Tally Course Note In English PDF Free Download

Tally Computer Course

Accounting:

The main purpose of accounting is to ascertain profit or loss during a specified period, to show the financial condition of the business on a particular date and to have control over the firm‟s property.

In other words, an account is a systematic record of all transactions relating to a person, an asset, a liability, an expense or an income.

The account is also called A/C. such accounting records are required to be maintained to measure the income of the business, and communicate the information.

So that it may be used by managers, owners and other parties.

Double Entry System:

We have seen earlier that every business transaction has two aspects, i.e. when we received something we give. Something else in return.

For Example, when we purchased goods for cash, we received goods and give cash in return, similarly, in a credit sale of goods, goods are given to the customer and the customer becomes the debtor for the number of goods sold to him.

This method of writing every transaction in two accounts is known as the Double Entry System Of Accounting of the two accounts, one account is given debit while the other account is given credit with an equal amount.

Thus, on any date, the total of all debits must be equal to the total of all credits because every debit has a corresponding credit.

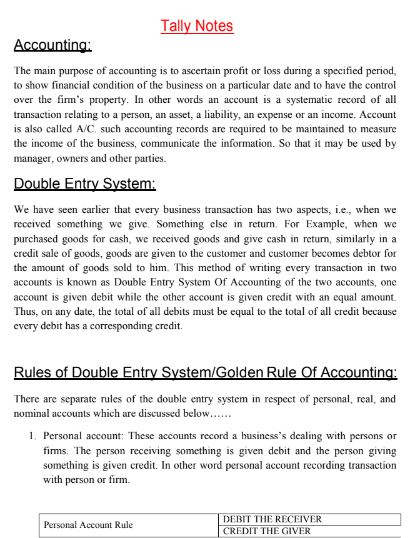

Rules of Double Entry System/Golden Rule Of Accounting:

There are separate rules of the double entry system in respect of personal, real, and nominal accounts which are discussed below

Personal account: These accounts record a business‟s dealing with persons or firms.

The person receiving something is given a debit and the person giving something is given credit.

Real account:

These are the accounts of asset entering the business that is given debit and asserts leaving the business is given credit.

In other words, the real account is the A/C of property or possession E.g.

Goods A/c, furniture A/C, etc. For example, when goods are sold for cash, the cash account will be given a debit as cash comes in and the Goods account will be credited as goods go out. So, the rule

Nominal/ Fictitious Account:

This account deals with expenses, income, profit and losses.

For example, when rent is paid to the landlord, the rent account will be debited as it is an expense and the cash account will be credited as it goes out. Other example commission A/C, Advertising A/C, Discount A/c, wages A/C.

Few basic terms:

Business transaction:

Any exchange of money or money‟s worth as goods and services between two parties are called a business transaction.

It may relate to the purchase and sale of goods, receipt and payment of cash and rending of service by one party to another.

Debtor:

A debtor is a person who owes money.

The amount due from him is called debt.

The amount due from a person as per the books of account is called a book debt.

For example, Sold Goods to Rolex Industry in credit.

The Rolex Industry is known as a Debtor.

Creditor:

A person to whom money is owing or payable is called a creditor.

For example, purchasing goods from Sam Company on a credit basis.

The Sam Company is known as Creditors.

Capital:

This is the owner‟s financial interest or holding in the business and is represented by the value of net assets.\

Goods:

This includes all articles, commodities or merchandise with which the business deals.

Thus, cloth would be goods for a dealer in cloth; furniture would be goods for a dealer in furniture and so on.

Assets:

Any physical thing or right owned that has monetary value is an asset.

In other words, an asset is an expenditure which results in acquiring of some property or benefit of a lasting nature.

Drawings:

Any amount or goods withdrawn by the owner of a business for personal use is called a drawing.

Voucher:

Any written document in support of a business transaction is called a voucher.

Journal:

Journal is derived from the French word “JOUR” which means a day.

Journal, therefore, means a daily record of business transactions.

Journal is a book of original entries because the transaction is first written in the journal from which it is posted to the ledger at any convenient time.

Ledger:

We know, the journal records all business transactions separately and date-wise.

The transaction pertaining to a particular person, assets, expense, or income is recorded at different places in the journal as they occur on different dates.

Hence, the journal fails to bring similar transactions together in one place.

Thus, to have a consolidated view of the similar transaction different accounts are prepared in the ledger.

A ledger account may be defined as a summary statement of all the transactions relating to a person, assert, expense or income which have taken place during a given period of time and shows their net effect.

| Author | – |

| Language | English |

| No. of Pages | 49 |

| PDF Size | 6 MB |

| Category | Education |

| Source/Credits | drive.google.com |

Related PDFs

Tally Course Note In English PDF Free Download