‘Printable Promissory Note Template’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Promissory Note Template Forms’ using the download button.

Blank Promissory Note Templates PDF Free Download

Promissory Note Templates

A promissory note is a written, enforceable agreement ( promise ) between a borrower and a lender, with the borrower agreeing to pay the lender back a specific sum of money.

That payment is either on-demand or within a set period of time, depending on the terms of the note.

Some examples of when you might use a promissory note include:

- Student loans

- Bank loans

- Car loans

- Personal loans between family members or friends.

- A promissory note is also referred to as a:

- Debit Note

- Demand Note

- Commercial Paper

- Notes Payable

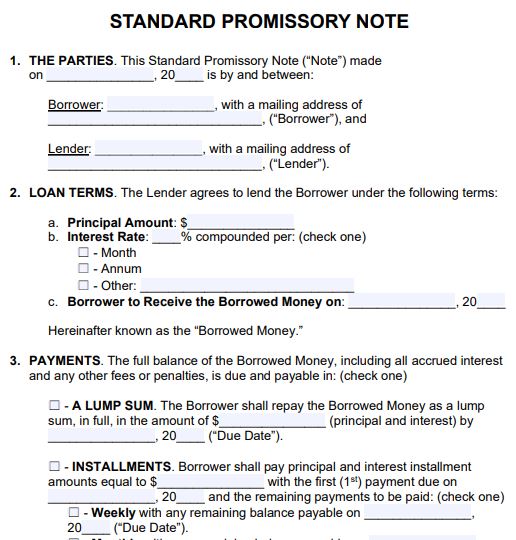

Create a Promissory Note

Step 1 – Agree to Terms

Before both parties sit down to write an agreement, the following should be verbally agreed upon:

Amount ($) – The amount of money being borrowed.

Due Date – When the borrowed money is supposed to be paid back in full.

Interest Rate – In other words, the fee for borrowing the money (See How to Calculate).

Make sure to check the Interest Rate Laws in your state (or “Usury Rate”). All states have a maximum amount of interest a lender is able to charge.

First Payment Due Date – When the borrower will begin paying back the loan.

Late Fee(s) – Penalties for late payment.

Origination Date – The day when the borrower receives the funds from the lender.

Security – Items such as vehicles or a second mortgage on a home are provided if the borrower does not repay the borrowed money.

This is to assure the lender that their money will be paid back either in cash or assets.

Terms of Repayment – Will the payments be made incrementally or as a lump sum?

Default Clause – Provide terms for if the borrower never pays back the money.

Co-Signer – If the borrower is not financially capable of borrowing the money, a second person should be named to pay back the loan if the borrower cannot do so themselves.

Step 2 – Run a Credit Report

It is always a good idea to run a credit report on any potential borrower as they may have outstanding debt unbeknownst to you.

Especially if the debt is IRS or child support related, it will take precedence over this promissory note.

Therefore, it is imperative that a credit report is run before making any type of agreement.

Reporting Agencies – It is a good idea to use Experian, which is free to the lender and charges $14.95 to the borrower.

Experian is known as the most sensitive credit agency usually providing the lowest score of the three credit bureaus (Experian, Equifax, and TransUnion).

Authorization Form – In order to run someone else’s credit, you must obtain written legal permission.

Step 3 – Security and Co-Signer(s)

If there are red flags that appear on the credit report the lender may want to have the borrower add security or a co-signer to the note.

Common types of security include motor vehicles, real estate (provided as a first or second mortgage), or any type of valuable asset.

This would mean that if the borrower does not repay the loan, the lender would be able to obtain full ownership of the security placed in the note.

In the case of a co-signer, they would be liable for the full extent of the money owed along with associated penalties or late fees.

Step 4 – Writing the Note

After the main terms of the note have been agreed upon, the lender and borrower should come together to authorize the formal agreement.

Signing – The money should be exchanged only after the note has been signed.

It is not required that a witness sign the form but is recommended.

For excessive amounts (more than $10,000), a notary public is recommended.

Step 5 – Paying Back the Money

The borrower should pay back the borrowed money on time and in accordance with the note.

If not, fees may be applied to the overall balance.

Once all the money has been fully paid back to the lender, a loan release form is created and issued to the borrower relieving them from any liability from the note.

If Payment is Late –

If the payment is late the lender should issue a demand letter.

This informs the borrower of the terms stated in the promissory note, such as the penalty for late payment or how much time they have before the loan defaults.

If Borrowed Money is Never Paid –

If the borrower defaults on the note, the lender can collect by minimizing their costs by seeking the funds through small claims court, which is typically limited for loans with a value of $10,000 or less depending on the jurisdiction.

If there was security placed in the note, the property or asset shall be turned over to the lender in accordance with the note. Otherwise, legal action will most likely be necessary for money owed in value of more than $10,000.

| Author | – |

| Language | English |

| No. of Pages | 4 |

| PDF Size | 1 MB |

| Category | Form |

| Source/Credits | eforms.com |

Blank Promissory Note Templates PDF Free Download