‘Pan Correction Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Pan Correction Form PDF’ using the download button.

Pan Correction Form PDF Free Download

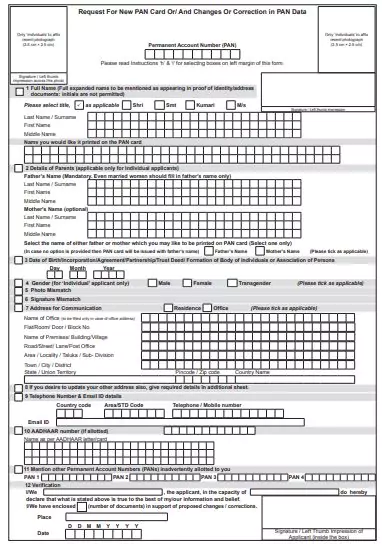

Pan Correction Form

The PAN correction form is an important document for individuals who need to update or correct their PAN card details. The form enables individuals to make changes to information such as name, date of birth, address, and other important details. The Income Tax Department of India provides this form on its official website, and it can be downloaded free of charge.

To complete the PAN correction form, it is essential to provide accurate and up-to-date information. Along with the form, individuals must also attach the required documents, such as proof of identity and proof of address. After the form is submitted, the Income Tax Department will verify the information provided and make the necessary changes. It is crucial to ensure that the information on the PAN card is correct and up-to-date, as it is used for various financial transactions and is a significant document for tax-related purposes.

Instructions for Filling Requests for New PAN Cards or Changes/Corrections in PAN Data

(a) Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Form should be filled in English only (b) Mention 10-digit PAN correctly.

(c) Each box, wherever provided, should contain only one character (alphabet /number/punctuation sign) leaving a blank box after each word.

(d) ‘Individual’ applicants should affix two recent colour photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photographs should not be stapled or clipped to the form. The clarity of the image on the PAN card will depend on the quality and clarity of the photograph affixed on the form.

(e) Signature / Left-hand thumb impression should be provided across the photo affixed on the left side of the form in such a manner that a portion of signature/impression is on the photo

as well as on form.

(f) Signature /Left-hand thumb impression should be within the box provided on the right side of the form. The signature should not be on the photograph affixed on the right side of the form. If there is any mark on this photograph such that it hinders the clear visibility of the face of the applicant, the application will not be accepted.

(g) Thumb impression, if used, should be attested by a Magistrate or a Notary Public or a Gazetted Officer under official seal and stamp.

h) For the issue of a new PAN card without any changes- In case you have a PAN but no PAN card and wish to get a PAN card, fill all columns of the form but do not tick any of the boxes on

the left margin. In case of loss of PAN card, a copy of FIR may be submitted along with the form.

(i) For changes or corrections in PAN data, fill all columns of the form and tick the box on the left margin of the appropriate row where change/ correction is required.

(j) Having or using more than one PAN is illegal. If you possess more than one PAN, kindly fill the details in Item No. 11 of this form and surrender the same.

Documents Required for PAN Card Correction

Here is a list of documents that individuals and companies need to submit if they wish to make changes or correct details on their PAN card:

Indian Citizens and Hindu Undivided Family (HUF)

| Identity Proof | Address Proof | Date of Birth Proof |

|---|---|---|

| Copy of | ||

| Aadhaar card | Aadhaar card | Aadhaar card |

| Voter ID | Voter ID | Voter ID |

| Driving license | Driving license | Driving license |

| Passport | Passport or spouse’s passport | Passport |

| Ration card with the applicant’s photo | Post office passbook with the applicant’s address | Mark sheet or m articulation certificate from a recognised board |

| Arm’s license | Latest property tax assessment order | Birth certificate |

| Any photo identity card issued by the central government, state government, or a public sector undertaking | Allotment letter of accommodation not more than three years old (issued by the state or central government) | Any photo identity card issued by the central government, state government, or a public sector undertaking |

| Pensioner’s card which has a photo of the applicant | Central government issued domicile certificate | Central government issued domicile certificate |

| Central government health service scheme card/ex-servicemen contributory health scheme card (with photo) | Property registration document | Central government health service scheme card/ex-servicemen contributory health scheme card (with photo) |

| Electricity bill, landline bill, broadband connection, water bill, piped gas bill (not more than 3 months old) | Pension payment order | |

| Bank account statement, credit card statement (not more than 3 months old) | Affidavit sworn before a magistrate | |

| Gas connection card (not more than 3 months old) | Marriage certificate issued by Registrar of Marriages | |

| Original of | ||

| Certificate of identity signed by an MP, MLA, MLC, or a gazetted officer | Certificates of address signed by an MP, MLA, MLC, or a gazetted officer | – |

| Bank certificate on the bank’s official letterhead with the name and stamp of the issuing officer (must also contain an attested photograph and bank account details) | Employer certificate | – |

| For HUF | ||

| An affidavit made by the Karta stating name, father’s name, and address of all members on the date of application | ||

For Foreign Citizens

| Identity Proof | Address Proof | |

|---|---|---|

| Copy of | ||

| Passport | Passport | |

| Person of Indian Origin (PIO) card | Person of Indian Origin (PIO) card | |

| Overseas Citizen of India (OCI) card | Overseas Citizen of India (OCI) card | |

| Citizenship identification number of the applicant (if they are a citizen of another country) | Citizenship identification number of the applicant (if they are a citizen of another country) | |

| Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas | Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas | |

| Bank account statement (in the country of residence) | – | |

| NRE bank account statement in India | – | |

| Certificate of Residence in India | – | |

| Registration certificate issued by the Foreigner’s Registration Office (must show an Indian address) | – | |

| Visa, appointment letter from an Indian company, and original certificate of Indian address issued by the employer | – | |

Indian Companies

Indian companies require:

| Type of Company | Documents (Copy of) |

|---|---|

| Company | Certificate of registration |

| Partnership | Certificate of registration or partnership deed |

| Limited Liability Partnership | Certificate of registration issued by the Registrar of LLPs |

| Association of Persons (Trust) | Trust deed, certificate of registration number issued by Charity Commissioner |

| Artificial Juridical Person, Body of Individuals, Local Authority, or Association of Persons | Agreement copy, certificate of registration number issued by Charity Commissioner registration of cooperative society, or any other document provided by a central or state government department |

Companies with a Registered Office Outside India

| Identity Proof | Address Proof |

|---|---|

| Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas | Tax payer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorised officials of scheduled banks registered in India which have branches overseas |

| Registration certificate issued in India or approval granted by Indian authorities to set up an office in India | Registration certificate issued in India or approval granted by Indian authorities to set up an office in India |

Supporting Documents for Changes in PAN

| Applicant Type | Document Applicable for Change in Name |

|---|---|

| Married ladies (change name on account of marriage) | Marriage certificate |

| Marriage invitation | |

| Passport showing husband’s name | |

| Publication of changed name in an official gazette | |

| Certificate issued by a gazetted officer | |

| Applicants other than married ladies | Publication of name in an official gazette |

| Certificate issued by a gazetted officer | |

| Companies | ROC’s certificate for name change |

| Firms, Limited Liability Partnerships | Revised partnership deed |

| Registrar of frim or LLP’s certificate for name change | |

| AOP/Trust/BOI/Local authority/AJP | Revised deed or agreement |

| Revised registration certificate |

| Author | Govt of India |

| Language | English |

| No. of Pages | 7 |

| PDF Size | 1 MB |

| Category | Income tax |

| Source/Credits | incometaxindia.gov.in |

Related PDFs

XXCXX 2023 Commonwealth Scholarship Form PDF

Mehangai Rahat Camp Form PDF In Hindi

Aadhaar Self Declaration Form PDF

Jati Janganana Bihar 2023 Form PDF In Hindi

Pan Correction Form PDF Free Download