‘Form No 15G’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Form 15G’ using the download button.

Form 15G PDF Free Download

Form 15G PDF Download

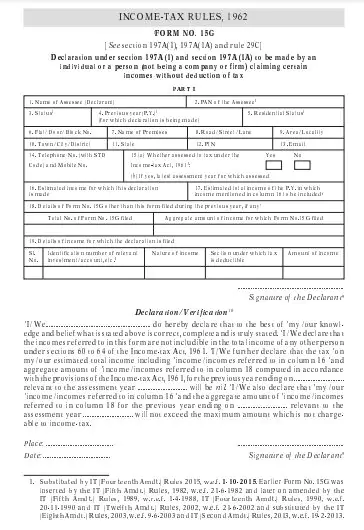

Form 15G is a declaration form that is submitted by an individual to their financial institution (such as a bank, post office, or other financial institution) to avoid tax deduction at source (TDS) on interest income.

It is typically used by individuals whose total income falls below the taxable limit and who have investments generating interest income, such as fixed deposits, recurring deposits, or other interest-bearing investments.

By submitting Form 15G, the individual is declaring that their total income is below the taxable limit and that they are not liable to pay tax on the interest income earned during the financial year.

If the financial institution is satisfied with the declaration, they will not deduct TDS on the interest income. However, it is important to note that if the individual’s income exceeds the taxable limit, they will be liable to pay tax on the interest income earned during the financial year and will need to file their tax returns accordingly.

Form 15G and Form 15H are self-declaration forms that individuals can submit to their financial institutions to avoid tax deduction at source (TDS) on their interest income. TDS is a tax deducted by the financial institution on the interest earned by an individual, and it is deducted at a specified rate if the interest income exceeds a certain threshold limit.

Form 15G is available for individuals who are below the age of 60 years and Hindu Undivided Families (HUFs), while Form 15H is available for senior citizens aged 60 years and above. Both forms fall under Section 197A of the Income Tax Act, 1961.

Form 15G allows individuals to declare their income to the financial institution and request them not to deduct TDS on their interest income for the financial year. To be eligible for Form 15G, the total interest income earned by the individual during the financial year should be less than the minimum taxable income of Rs 2.5 lakhs. The form must be submitted to all the branches and banks where the individual holds an interest-bearing deposit.

On the other hand, Form 15H is a self-declaration form that senior citizens can submit to avoid TDS on their interest income earned from investments in fixed deposits (FDs) and recurring deposits (RDs). To be eligible for Form 15H, the senior citizen should be 60 years or above and have a taxable income of up to Rs 3 lakhs for the financial year.

In the case of individuals above 80 years of age, the maximum exempt income is Rs 5 lakhs. Similar to Form 15G, Form 15H must be submitted to all the branches and banks where the individual holds an interest-bearing deposit.

It is important to note that these forms are only applicable to resident Indians. Also, individuals should submit these forms before the payment of any interest by the financial institution. By submitting these forms, individuals can avoid TDS on their interest income and receive the full interest earned on their deposits without any tax deductions.

If you want to fill out Form 15G online, some banks and financial institutions may offer that option. To complete the declaration, you will need to provide the following details:

- Name and PAN (mandatory)

- Tax status – Individual, HUF, or Trust

- Previous Year (for which you are submitting the Form)

- Residential status in the Previous Year

- Residential address and contact information (mobile, email)

- Option A – Select “Yes” if your taxable income was more than the maximum exempt limit in the past six previous years.

- Mention the latest year when your taxable income exceeded the maximum exempt limit.

- Estimated income for which the Declaration is made – this refers to your estimated income for the current Previous Year.

- Estimated Total Income of the P.Y. – This is the income of the current Previous Year that you have already received.

- Details of Other Form 15G (or 15H) filed in the P.Y. – enter the number of forms filed during the previous year and the aggregate income amount for those years.

- Details of income for which declaration is filed – provide the income sources, nature, Income Tax Section, and amounts of income.

Once you have filled in all the required details, review the form, and submit it online. Make sure to print a copy of the submitted form for your records. It is essential to ensure that the details provided are accurate to avoid any issues with TDS deductions.

| Author | – |

| Language | English |

| No. of Pages | 3 |

| PDF Size | 0.1 MB |

| Category | Government |

| Source/Credits | incometaxindia.gov.in |

Related PDFs

XXCXX 2023 Commonwealth Scholarship Form PDF

Form 15G PDF Free Download