‘Paper Forms W-2 And Instructions’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘IRS W-2 Form’ using the download button.

Printable W2 Form Wax And Tax Statement PDF Free Download

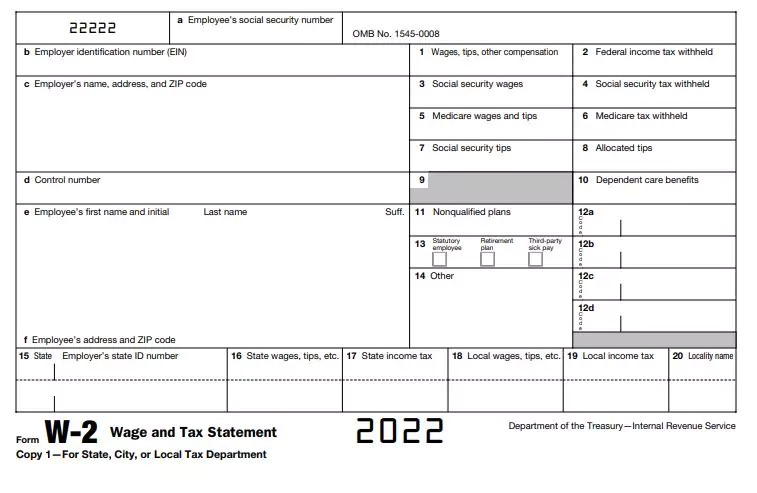

W-2 Form Wage And Tax Statement PDF

Every employer engaged in a trade or business that pays remuneration for services performed by an employee, including non-cash payments of $600 or more for the year (if any income, Social Security, or Medicare taxes are withheld All amounts involved) must file a Form W. 2 for each employee (regardless of whether the employee belongs to the employer) To whom:

Income, Social Security, or Medicare taxes were withheld. Income tax would have been withheld if the employee had not claimed more than one withholding allowance or claimed an exemption from withholding on Form W-4, Employee’s Withholding Allowance Certificate.

Notice to Employee

Do you have to file? Refer to the Form 1040 instructions to determine if you are required to file a tax return. Even if you don’t have to file a tax return, you may be eligible for a refund if box 2 shows an amount or if you are eligible for any credit.

Earned income credit (EIC). You may be able to take the EIC for 2022 if your adjusted gross income (AGI) is less than a certain amount.

The amount of the credit is based on income and family size. Workers without children could qualify for a smaller credit.

You and any qualifying children must have valid social security numbers (SSNs). You can’t take the EIC if your investment income is more than the specified amount for 2022 or if income is earned for services provided while you were an inmate at a penal institution.

For 2022 income limits and more information, visit www.irs.gov/EITC. See also Pub. 596, Earned Income Credit.

Any EIC that is more than your tax liability is refunded to you, but only if you file a tax return.

Employee’s social security number (SSN). For your protection, this form may show only the last four digits of your SSN.

However, your employer has reported your complete SSN to the IRS and the Social Security Administration (SSA).

Clergy and religious workers. If you aren’t subject to Social Security and Medicare taxes, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

Corrections. If your name, SSN, or address is incorrect, correct Copies B, C, and 2 and ask your employer to correct your employment record.

Be sure to ask the employer to file Form W-2c, Corrected Wage and Tax Statement, with the SSA to correct any name, SSN, or money amount error reported to the SSA on Form W-2.

Be sure to get your copies of Form W-2c from your employer for all corrections made so you may file them with your tax return.

If your name and SSN are correct but aren’t the same as shown on your social security card, you should ask for a new card that displays your correct name at any SSA office or by calling 800-772-1213. You may also visit the SSA website at www.SSA.gov.

Cost of employer-sponsored health coverage (if such cost is provided by the employer). The reporting in box 12, using code DD, of the cost of employer-sponsored health coverage is

for your information only. The amount reported with code DD is not taxable.

Credit for excess taxes. If you had more than one employer in 2022 and more than $9,114 in social security and/or Tier 1 railroad retirement (RRTA) taxes were withheld, you may be able to claim a credit for the excess against your federal income tax.

See the Form 1040 instructions. If you had more than one railroad employer and more than $5,350.80 in Tier 2 RRTA tax was withheld, you may be able to claim a refund on Form 843. See the Instructions for Form 843.

Instructions for Employee

Box 8. This amount is not included in boxes 1, 3, 5, or 7. For information on how to report tips on your tax return, see the Form 1040 instructions.

You must file Form 4137, Social Security and Medicare Tax on Unreported Tip Income, with your income tax return to report at least the allocated tip amount unless you can prove with adequate records that you received a smaller amount.

If you have records that show the actual amount of tips you received, report that amount even if it is more or less than the allocated tips.

Use Form 4137 to figure out the Social Security and Medicare tax owed on tips you didn’t report to your employer.

Enter this amount on the wages line of your tax return. By filing Form 4137, your social security tips will be credited to your social security record (used to figure out your benefits).

Box 10. This amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan).

Any amount over your employer’s plan limit is also included in box 1. See Form 2441. Box 11.

This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or a nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount.

This box shouldn’t be used if you had a deferral and a distribution in the same calendar year.

| Author | – |

| Language | English |

| No. of Pages | 11 |

| PDF Size | 5 MB |

| Category | Forms |

| Source/Credits | irs.gov |

Related Posts

How To Create A CPN Number PDF

W2 Form Wax And Tax Statement PDF Free Download