‘GPF Withdrawal Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘GPF Withdrawal Form’ using the download button.

GPF Withdrawal Form PDF Free Download

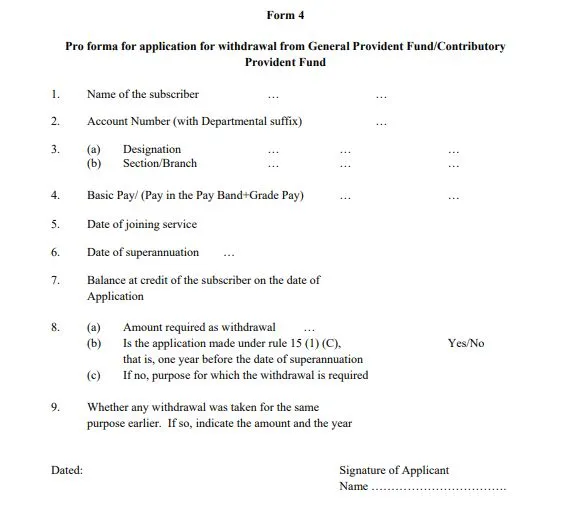

GPF Withdrawal Form

The non-refundable GPF withdrawal rules are about when and how much a subscriber can withdraw the funds.

The basic criterion for the non-refundable withdrawal is that you should have completed at least 15 yrs of service or within 10 yrs of the date of retirement or superannuation (whichever is earlier).

The GPF withdrawal rules are as follows.

- You can withdraw 75% of the outstanding PF account balance to fund education or any event like marriage (yours or dependent family members).

- You can withdraw 90% of the outstanding amount in the case of any medical emergency for yourself or a dependent family member. In 7 days you can receive the amount you want to withdraw.

- You can withdraw 75% of the account balance to purchase a new house or land, renovate/repair it or repay an existing home loan.

- You can withdraw 75% of the balance or 3/4th of the vehicle value (whichever is lower) to purchase a vehicle, pay off a car loan, or repair the car.

- You can withdraw 90% of the balance before 2 yrs of retirement without providing any reason.

- You can withdraw funds to purchase large home appliances like air conditioners or washing machines. However, the funds must be used only to purchase the products you state on the withdrawal form.

- The nominee can withdraw the outstanding amount in the event of the subscriber’s death. They are also entitled to an additional amount of an average of 3 yrs PF balance preceding the event. This additional amount should not be more than Rs. 60,000. Also, as per the GPF part final withdrawal rules, the nominee will be eligible for the additional fund only if the subscriber has been in service for a minimum of 5 yrs.

- At the time of retirement or superannuation, the subscriber is allowed to withdraw the entire amount.

The GPF contributors can get an advance of 3 months’ pay or half the account balance (whichever is lower). The GPF temporary advance rules are as follows:

- You can get an advance to fund the higher education of a dependent family member or any event like a marriage.

- You can get an advance in the case of any medical emergency for yourself or a dependent family member.

- You can get an advance to purchase large home appliances like TV, air conditioners or washing machines. Note that funds must be used only for the reason stated.

- You can get an advance to meet the costs of legal proceedings put on or against yourself or a dependent family member.

The advance provided should be paid back in equal instalments for up to 12-24 months.

The recovery tenure can be extended to 36 months only if the advance payment is more than 3 months’ pay.

| Language | English |

| No. of Pages | 2 |

| PDF Size | 0.1 MB |

| Category | Government |

| Source/Credits | pensionersportal.gov.in |

GPF Withdrawal Form PDF Free Download