‘Tds Rate Chart For Fy 2023-24’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘TDS Deduction Rate Chart’ using the download button.

TDS Deduction Rate Chart for PDF Free Download

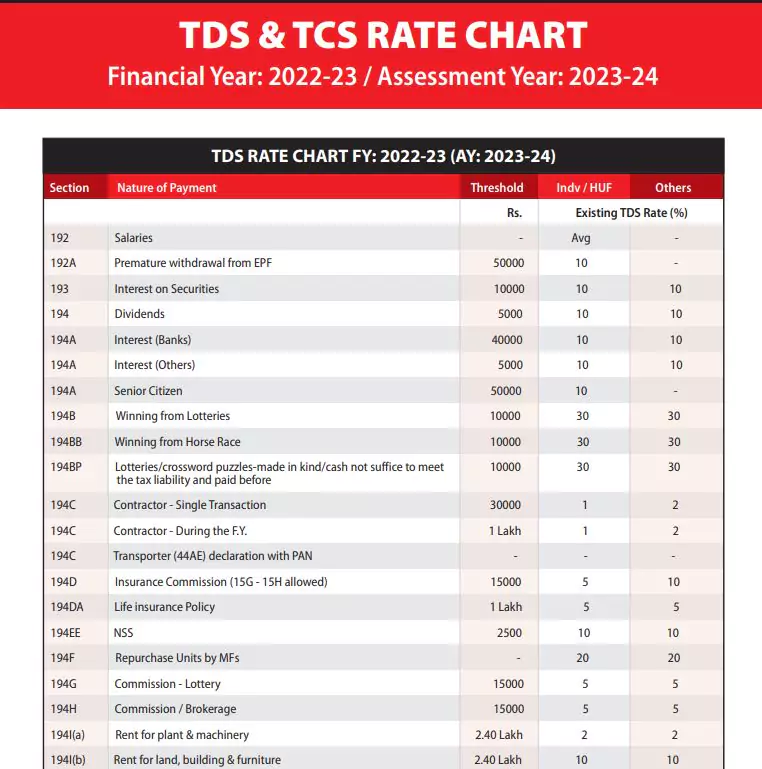

TDS Rate Chart FY 2023-24

- The above list covers most of the sections applicable for domestic transactions

- Section – 206AA

- Section – 206AB

Notwithstanding anything contained in any other provisions of the Income Tax Act-1961, any person entitled to receive any sum or income or amount, on which tax is deductible under Chapter XVIIB (hereafter referred to as deductee) shall furnish his Permanent Account Number to the person responsible for deducting such tax (i.e. deductor), failing which tax shall be deducted at the higher of the following rates, namely:- - (i) at the rate specied in the relevant provision of this Act; or

(ii) at the rate or rates in force; or

(iii) at the rate of twenty per cent:

Provided that where the tax is required to be deducted under section 194-O, the provisions of clause (iii) shall apply as if for the words “twenty per cent”, the words “ve per cent” had been substituted. - Provided further that where the tax is required to be deducted under section 194Q, the provisions of

clause (iii) shall apply as if for the words “twenty per cent”, the words “ve per cent” had been

substituted. - Notwithstanding anything contained in any other provisions of the Income Tax Act-1961, where tax is required to be deducted at source under the provisions of Chapter XVIIB, other than sections 192, 192A, 194B, 194BB, 194LBC or 194N on any sum or income or amount paid, or payable or credited, by a person to a specied person, the tax shall be deducted at the higher of the following rates, namely:––

(I) at twice the rate specied in the relevant provision of the Act; or

(ii) at twice the rate or rates in force; or

(iii) at the rate of ve per cent. - If the provisions of section 206AA is applicable to a specied person, in addition to the provision of this

section, the tax shall be deducted at higher of the two rates provided in this section and in section 206AA. - For the purposes of this section “specied person” means a person who has not led the returns of income for both of the two assessment years relevant to the two previous years immediately prior to the previous year in which tax is required to be deducted, for which the time limit of ling return of income under sub-section (1) of section 139 has expired; and the aggregate of tax deducted at source and tax collected at source in his case is rupees fty thousand or more in each of these two previous years.

- Provided that the specified person shall not include a non-resident who does not have a

permanent establishment in India.

| Author | TDS |

| Language | English |

| No. of Pages | 5 |

| PDF Size | 1 MB |

| Category | chart |

| Source/Credits | tdsman.com |

TDS Deduction Rate Chart for PDF Free Download