‘Taxation Law Notes’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Taxation Law Notes’ using the download button.

Taxation Law Notes PDF Free Download

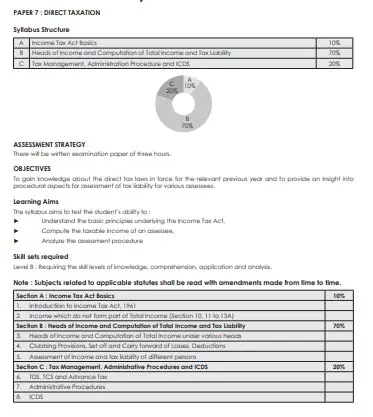

Taxation Law Notes PDF

In a Welfare State, the Government takes primary responsibility for the welfare of its citizens, as in matters of health care, education, employment, infrastructure, social security, and other development needs. To facilitate these, Government needs revenue.

Taxation is the primary source of revenue for the Government for incurring such public welfare expenditures. In other words, the Government is taking taxes from the public on its one hand, and through another hand; it incurs welfare expenditure for the public at large.

However, no one enjoys handing over his hard-earned money to the government to pay taxes. Thus, taxes are compulsory or enforced contributions to the Government revenue by the public. The government may levy taxes on income, business profits or wealth or add it to the cost of some goods, services, and transactions.

There are two types of taxes: Direct Tax and Indirect Tax Tax, of which incidence and impact fall on the same person, is known as Direct Tax, such as Income Tax. On the other hand, tax, of which incidence and impact fall on two different persons, is known as Indirect Tax, such as GST, etc.

It means, in the case of Direct Tax, tax is recovered directly from the assessee, who ultimately bears such taxes, whereas, in the case of Indirect Tax, tax is recovered from the assessee, who passes such burden to another person & is ultimately borne by consumers of such goods or services Direct Tax Indirect Tax

● Incidence and impact fall on the same person

● Assessee, himself bears such taxes. Thus, it pinches the taxpayer.

● Levied on income

● E.g. Income Tax

● Progressive in nature i.e., higher taxes are levied on a person earning a higher income and vice versa.

● Incidence and impact fall on two different persons

● Tax is recovered from the assessee, who passes such burden to another person. Thus, it does not pinch the taxpayer.

● Levied on goods and services. Thus, this type of tax leads to inflation and has a wider base.

● E.g. GST, Customs Duty, etc.

● Regressive in nature i.e., all persons will bear equal wrath of tax on goods or services consumed by them irrespective of their ability.

● Useful tools to promote social welfare by checking the consumption of harmful goods or sinful goods through a higher rate of tax.

CONSTITUTIONAL VALIDITY OF TAXES

The Constitution of India is the supreme law of India. It consists of a Preamble, 22 parts containing 444 articles, and 12 schedules. Any tax law, which is not in conformity with the Constitution, is called ultra vires the Constitution and held as illegal and void.

Some of the provisions of the Constitution are given below: Article 265 of the Constitution lays down that no tax shall be levied or collected except by the authority of law.

It means the tax proposed to be levied must be within the legislative competence of the legislature imposing the tax1. Article 246 read with Schedule VII divides the subject matter of law made by the legislature into three categories

● Union list (only the Central Government has the power of legislation on subject matters covered in the list)

● State list (only State Government has the power of legislation on subject matters covered in the list)

● Concurrent list (both Central &State Governments can pass legislation on subject matters).

If a state law relating to an entry in List III is repugnant to a Union law relating to that entry, the Union law will prevail, and the state law shall, to the extent of such repugnancy, be void. (Article 254).

SOURCES OF INCOME TAX LAW IN INDIA

- Income Tax Act, 1961 (Amended up to date) The provisions of income tax extend to the whole of India and became effective from 1/4/1962 (Sec. 1). The Act contains provisions for – (a) determination of taxable income; (b) determination of tax liability; (c) procedure for assessment, appeals, penalties, and prosecutions; and (d) powers and duties of Income tax authorities.

2. Annual Amendments (a) Income Tax Act has undergone several amendments from the time it was originally enacted through the Union Budget. Every year, a Finance Bill is presented before the Parliament by the Finance Minister.

The Bill contains various amendments which are sought to be made in the areas of direct and indirect taxes levied by the Central Government. (b) When the Finance Bill is approved by both Houses of Parliament and receives the assent of the President, it becomes the Finance Act. The provisions of such Finance Act are thereafter incorporated in the Income Tax Act.

(c) If on the 1st day of April of the Assessment Year, the new Finance Act has not been enacted, the provisions in force in the preceding Assessment Year or the provisions proposed in the Finance Bill before the Parliament, whichever is more beneficial to the assessee, will apply until the new provisions become effective [Sec. 294] Note: Besides these amendments, whenever it is found necessary, the Government introduces amendments in the form of various Amendment Acts and Ordinances.

3. Income-tax Rules, 1962 (Amended up to date) (a) As per Sec. 295, the Board may, subject to the control of the Central Government, make rules for the whole or any part of India for carrying out the purposes of the Act. (b) Such rules are made applicable by notification in the Gazette of India.

(c) These rules were first made in 1962 and are known as Income Tax Rules, 1962. Since then, many new rules have been framed or existing rules have been amended from time to time and the same has been incorporated in the aforesaid rules.

4. Circulars and Clarifications by CBDT (a) U/s 119, the Board may issue certain circulars and clarifications from time to time, which have to be followed and applied by the Income-tax authorities.

(b) Effect of circulars: These circulars or clarifications are binding upon the Income tax authorities, but the same are not binding on the assessee. However, the assessee can claim benefits under such circulars. Note: These circulars are not binding on the Income Tax Appellate Tribunal or on the Courts.

5. Judicial decision (a) Decision of the Supreme Court: Any decision given by the Supreme Court shall be applicable as law till there is any change in the law by the Parliament.

Such decision shall be binding on all the Courts, Tribunals, Income tax authorities, assessee, etc. (b) Contradiction in the decisions of the Supreme Court: In case, there is apparently a contradiction in two decisions, the decision of the larger bench, whether earlier or later, shall always prevail.

However, where decisions are given by benches having an equal number of judges, the decision of the recent case shall be applicable. (c) Decisions given by a High Court or ITAT: Decisions given by a High Court or ITAT are binding on all assessees and Income tax authorities, which fall under their jurisdiction, unless it is overruled by a higher authority.

BASIC PRINCIPLES FOR CHARGING INCOME TAX [SEC. 4]

1. Income of the previous year of a person is charged to tax the immediately following assessment year.

2. Rate of tax is applicable as specified by the Annual Finance Act of that year. Further, though the Finance Act prescribes the rates of tax, in respect of certain income, the Income Tax Act itself has prescribed specific rates, e.g. Lottery income is to be taxed @ 30% (Sec.115BB), Long term capital gain is to be taxed @ 20% (Sec.112), short term capital gain on listed shares u/s 111A is to be taxed @ 15%, etc.

3. In respect of income chargeable to tax, tax shall be deducted at source, or paid in advance (wherever applicable). Sec.

4 is a charging section and it is the backbone of the Income Tax Act. The tax liability arises by virtue of this section and it arises at the close of a previous year. However, the finalization of the amount of tax liability is postponed to the assessment year. It follows the rule that the liability to tax is not dependent upon assessment.

| Language | English |

| No. of Pages | 632 |

| PDF Size | 3.5 MB |

| Category | Law |

| Source/Credits | icmai.in |

Related PDFs

Syllogism Questions In English PDF

Daily Use English Words With Meaning In Hindi PDF

Water Pollution EVS Project PDF

Nature And Scope Of Comparative Politics PDF

BA Sociology 1st Semester Notes PDF

Taxation Law Notes Book PDF Free Download