‘Section 54F Of Income Tax Act’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Section 54F Of Income Tax Act’ using the download button.

Section 54F Of Income Tax Act PDF Free Download

Section 54F Of the Income Tax Act

Before we get into the details of section 54F, it is important that you understand what capital assets are.

Capital assets include all types of assets held by a person, which may or may not be related to his profession or business.

A piece of land, a house, trademarks, vehicles, machinery, patents, and jewelry can also come under the umbrella of capital assets.

However, you need to bear in mind that the following do not fall into the category of capital assets. :

- Raw materials or consumables that are held for business

- Clothes, furniture held for personal use

- Rural agricultural land.

For example, Ravi Khanna purchased gold in May 2022 for INR 10 lakhs and sold it in September 2023 for INR INR 15 lakhs. The gold will be treated as a short-term capital asset, and the INR 5 lakhs profit will be treated as capital gain and will attract tax.

Example: Jai Rathore is a property dealer. He purchased a flat worth INR 25 lakhs in March 2021 and sold it for INR 30 lakhs in June 2022. Because he made the sale/ purchase as a part of his business, it would not be treated as a capital asset. The profit will be treated as his business income and not a capital gain.

For taxation purposes, capital assets can be further classified into two types:

- Short-Term Capital Asset:

A short-term capital asset, STCA, is an asset that you hold for a period of 36 months or less immediately preceding the date of its transfer. - Long-Term Capital Asset:

A capital asset that you hold for 36 months or more immediately preceding the date of its transfer is considered to be a long-term capital asset, LTCA.

Note:

- For Assets such as preference shares or equity, that are listed in a recognized Indian stock exchange, the holding period is considered as 12 months rather than 36 months

- In the case of unlisted shares of a company, the period of holding is considered 24 months, rather than 36 months.

What is Section 54F of the Income Tax Act?

Section 54F of the Income Tax Act, 1961, is a section that allows tax exemption on the long-term capital gains earned from selling a capital asset other than a house property. So, if you sell a capital asset like shares, bonds, jewelry, gold, etc.,

and reinvest the sale proceeds towards the purchase or construction of a house property, the returns earned on the sale of the capital asset would be allowed as an exemption from tax under Section 54F.

| Number of shares that you own | 10,000 |

| Purchase price of the shares | INR 50 |

| Cost of buying the shares | INR 5 lakhs |

| The amount received on selling the shares | INR 100 |

| Amount received on selling the shares | 100*10,000 = INR 10 lakhs |

| Capital gains earned | 10 lakhs – 5 lakhs = INR 5 lakhs |

Now, you invest the sale proceeds of INR 10 lakhs into a house property.

In this case, according to Section 54F of the Income Tax Act, the capital gain of INR 5 lakhs would not be taxed in your hands.

If, however, you use the amount of INR 10 lakhs to invest in any other asset, the gains of INR 5 lakhs would become taxable in your hands.

This is how Section 54F works.

Union budget 2023-24 on Section 54F of income tax:

In the Union Budget 2023-24, Finance Minister Smt. Nirmala Sitharaman proposed certain provisions which are related to capital gains.

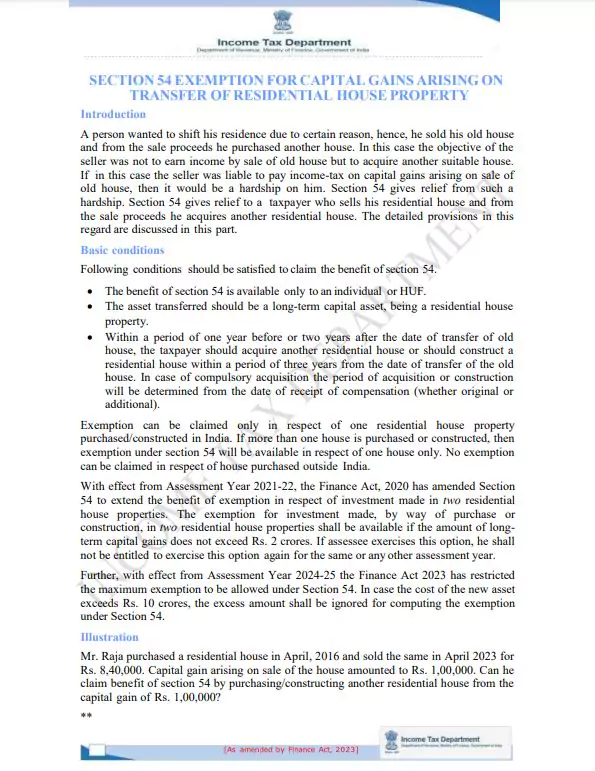

We know that section 54 gives exemption from long-term capital gain on the sale of residential property if the indexed capital gain (long term) is utilized for the purchase or construction of a house within the given time frame.

Similarly, section 54F provides an exemption from any long-term capital gain made by you on the sale of an asset, other than a house (residential), provided the net consideration received is utilized for the purpose of purchasing or constructing a house within the specified period. be taken for the frame.

At present, there is no limit on the amount for which you can claim exemption from LTCG while investing in a residential house.

However, the budget proposes to impose a limit of Rs 10 crore, subject to which you can claim tax exemption under section 54 or 54F.

This step has been taken to overcome the shortage of housing and to speed up the construction of houses.

The Finance Department claimed huge deductions on high net worth taxpayers, defeating the very purpose. So, if you are planning to reinvest the sale proceeds of more than Rs 10 crore, you might want to think again as it will not fetch you tax benefits after April 1, 2023.

| Language | English |

| No. of Pages | 17 |

| PDF Size | 1 MB |

| Category | Law |

| Source/Credits | incometaxindia.gov.in |

Related PDFs

World Air Quality Report 2023 PDF

Varahamihira The Brihat Jataka PDF

Divya Prerna Prakash PDF In Hindi

Maruti INVICTO Brochure 2023 PDF

Section 54F Of Income Tax Act PDF Free Download