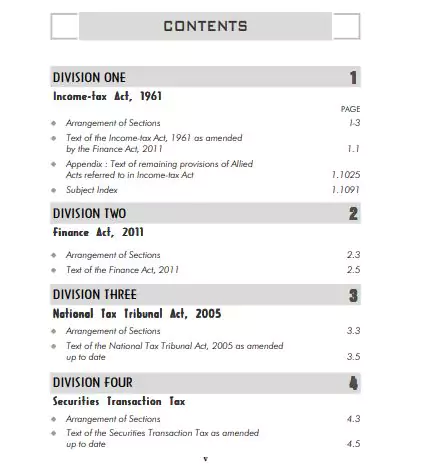

‘Income Tax ACT 1961 Notes’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Income Tax ACT 1961 Notes’ using the download button.

Income Tax ACT 1961 Notes PDF Free Download

Income Tax ACT 1961 Notes PDF

Short title, extent and commencement. 1 1. 2 (1) This Act may be called the Income-tax Act, 1961. (2) It extends to the whole of India. (3) Save as otherwise provided in this Act, it shall come into force on the 1st day of April, 1962.

Definitions. 2. In this Act, unless the context otherwise requires,— 3[(1) “advance tax” means the advance tax payable in accordance with the provisions of Chapter XVII-C;] 4 [5 (1A)] 6 “agricultural income”7 means8— 9 [(a) any rent10 or revenue10 derived10 from land10 which is situated in India and is used for agricultural purposes;]

(b) any income derived from such land10 by— (i) agriculture10; or (ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by a cultivator or receiver of rent-in-kind to render the produce raised or received by him fit to be taken to market10; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by him, in respect of which no process has been performed other than a process of the nature described in paragraph (ii) of this sub-clause ;

(c) any income derived from any building owned and occupied by the receiver of the rent or revenue of any such land, or occupied by the cultivator or the receiver of rent-in-kind, of any land with respect to which, or the produce of which, any process mentioned in paragraphs (ii) and (iii) of sub-clause (b) is carried on :

9 [Provided that— (i) the building is on or in the immediate vicinity of the land, and is a building which the receiver of the rent or revenue or the cultivator, or the receiver of rent-in-kind, by reason of his connection with the land, requires as a dwelling house, or as a store-house, or other out-building, and

(ii) the land is either assessed to land revenue in India or is subject to a local rate assessed and collected by officers of the Government as such or where the land is not so assessed to land revenue or subject to a local rate, it is not situated—

(A) in any area which is comprised within the jurisdiction of a municipality (whether known as a municipality, municipal corporation, notified area committee, town area committee, town committee or by any other name) or a cantonment board and which has a population of not less than ten thousand according to the last preceding census of which the relevant figures have been published before the first day of the previous year ; or

(B) in any area within such distance, not being more than eight kilometres, from the local limits of any municipality or cantonment board referred to in item (A), as the Central Government may, having regard to the extent of, and scope for, urbanisation of that area and other relevant considerations, specify in this behalf by notification in the Official Gazette11.]

12[ 13[Explanation 1.]—For the removal of doubts, it is hereby declared that revenue derived from land shall not include and shall be deemed never to have included any income arising from the transfer of any land referred to in item (a) or item (b) of sub-clause (iii) of clause

(14) of this section.] 14[Explanation 2.—For the removal of doubts, it is hereby declared that income derived from any building or land referred to in subclause (c) arising from the use of such building or land for any purpose (including letting for residential purpose or for the purpose of any business or profession) other than agriculture falling under subclause (a) or sub-clause (b) shall not be agricultural income.]

15[Explanation 3.—For the purposes of this clause, any income derived from saplings or seedlings grown in a nursery shall be deemed to be agricultural income;]

16[17[(1B)] “amalgamation”, in relation to companies, means the merger of one or more companies with another company or the merger of two or more companies to form one company (the company or companies which so merge being referred to as the amalgamating company or companies and the company with which they merge or which is formed as a result of the merger, as the amalgamated company) in such a manner that—

(i) all the property of the amalgamating company or companies immediately before the amalgamation becomes the property of the amalgamated company by virtue of the amalgamation ; (ii) all the liabilities of the amalgamating company or companies immediately before the amalgamation become the liabilities of the amalgamated company by virtue of the amalgamation ;

(iii) shareholders holding not less than 18[three-fourths] in value of the shares in the amalgamating company or companies (other than shares already held therein immediately before the amalgamation by, or by a nominee for, the amalgamated company or its subsidiary) become shareholders of the amalgamated company by virtue of

the amalgamation, otherwise than as a result of the acquisition of the property of one company by another company pursuant to the purchase of such property by the other company or as a result of the distribution of such property to the other company after the winding up of the firstmentioned company ;]

19[(1C) “Additional Commissioner” means a person appointed to be an Additional Commissioner of Income-tax under sub-section (1) of section 117; (1D) “Additional Director” means a person appointed to be an Additional Director of Income-tax under sub-section

(1) of section 117 ;] (2) “annual value”, in relation to any property, means its annual value as determined under section 23 ; (3) 20[* * *] (4) “Appellate Tribunal” means the Appellate Tribunal constituted under section 252 ; (5) “approved gratuity fund” means a gratuity fund which has been and continues to be approved by the

21[Chief Commissioner or Commissioner] in accordance with the rules contained in Part C of the Fourth Schedule ; (6) “approved superannuation fund” means a superannuation fund or any part of a superannuation fund which has been and continues to be approved by the 21[Chief Commissioner or Commissioner] in accordance with the rules contained in Part B of the Fourth Schedule ;

22(7) “assessee”23 means a person by whom 24[any tax] or any other sum of money is payable under this Act, and includes— (a) every person in respect of whom any proceeding under this Act has been taken for the assessment of his income

25[or assessment of fringe benefits] or of the income of any other person in respect of which he is assessable, or of the loss sustained by him or by such other person, or of the amount of refund due to him or to such other person ; (b) every person who is deemed to be an assessee under any provision of this Act ; (c) every person who is deemed to be an assessee in default under any provision of this Act ; 26[(7A) “Assessing Officer” means the Assistant Commissioner

27[or Deputy Commissioner] 28[or Assistant Director] 27[or Deputy Director] or the Income-tax Officer who is vested with the relevant jurisdiction by virtue of directions or orders issued under sub-section (1) or subsection (2) of section 120 or any other provision of this Act, and the

29[Additional Commissioner or] 30[Additional Director or] 31[Joint Commissioner or Joint Director] who is directed under clause (b) of sub-section (4) of that section to exercise or perform all or any of the powers and functions conferred on, or assigned to, an Assessing Officer under this Act ;] (8) “assessment”32 includes reassessment ; (9) “assessment year” means the period of twelve months commencing on the 1st day of April every year ; 33[(9A) “Assistant Commissioner” means a person appointed to be an Assistant Commissioner of Income-tax 34[or a Deputy Commissioner of Income-tax] under sub-section (1) of section 117 ;

] 35[(9B) “Assistant Director” means a person appointed to be an Assistant Director of Income-tax under sub-section (1) of section 117;] (10) “average rate of income-tax” means the rate arrived at by dividing the amount of income-tax calculated on the total income, by such total income ;

36[(11) “block of assets” means a group of assets falling within a class of assets comprising— (a) tangible assets, being buildings, machinery, plant or furniture; (b) intangible assets, being know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, in respect of which the same percentage of depreciation is prescribed ;] (12) “Board” means the

37[Central Board of Direct Taxes constituted under the Central Boards of Revenue Act, 1963 (54 of 1963)] ; 38[(12A) “books or books of account” includes ledgers, day-books, cash books, account-books and other books, whether kept in the written form or as print-outs of data stored in a floppy, disc, tape or any other form of electro-magnetic data storage device;] 39(13) “business”40 includes any trade40, commerce or manufacture or any adventure

40 or concern in the nature of trade40, commerce or manufacture ; 41(14) “capital asset” means property42 of any kind held by an assessee, whether or not connected with his business or profession, but does not include— (i) any stock-in-trade, consumable stores or raw materials held for the purposes of his business or profession ;

43[(ii) personal effects44, that is to say, movable property (including wearing apparel and furniture) held for personal use 44 by the assessee or any member of his family dependent on him, but excludes— (a) jewellery; (b) archaeological collections; (c) drawings;

| Language | English |

| No. of Pages | 1251 |

| PDF Size | 8 MB |

| Category | Law |

| Source/Credits | dor.gov.in |

Related PDFs

India Year Book 2021 Government PDF In English

List Of Important Days In India PDF

My Vision For India In 2047 PDF

BA Sociology 1st Semester Notes PDF

Income Tax ACT 1961 Notes Book PDF Free Download