‘HDFC Fastag Application Apply’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Hdfc Fastag Login’ using the download button.

HDFC Fastag Application Form PDF Free Download

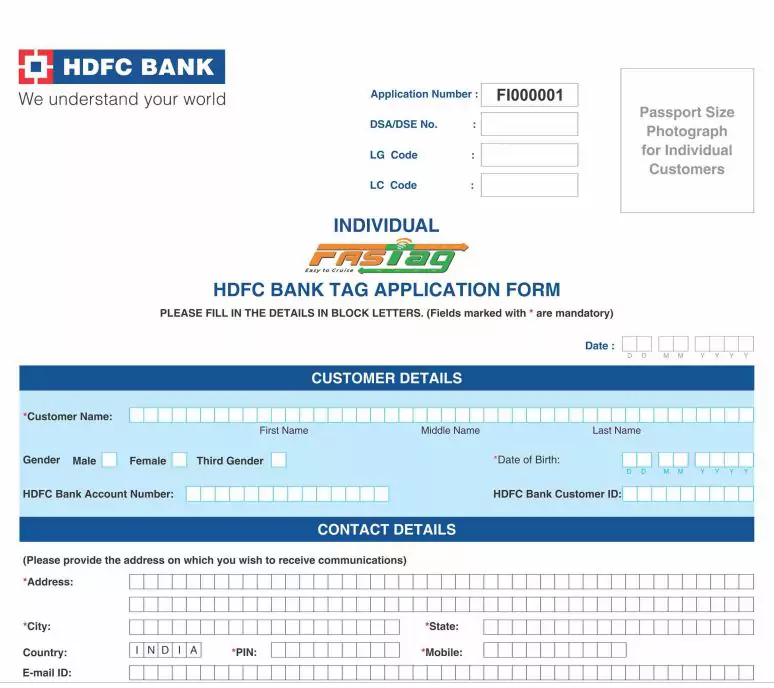

HDFC Fastag Application Form

Indian roads and especially highways have become really good in the last few years. The infrastructure of the roads have been improved to a great extent which provides uninterrupted traffic flows without any jams on the roads. If you are a frequent traveller, you might not face any problems on these roads and can have a smooth journey, but still there were some things which were not under our control and usually you would hate during your journeys. One of such problems travellers face was long queues at toll plazas across the highway, which would waste a lot of time waiting for your turn. But now the government has introduced FASTag for vehicles which have been made mandatory for four wheelers from December 2019. More than 600+ toll plazas across the country are equipped with FASTag. Let us get to know about what is FASTag, benefits of FASTag, how to get FASTag for your vehicles and when is your FASTag blacklisted.

Things to know about FASTag

Though FASTag is easy and convenient method to pay your toll tax without any human intervention, but still there are some points about the technology which are necessary to know before you move your vehicle on highways:

- FASTag can be used at any toll plaza across the country irrespective of the fact that whosoever is the acquirer of toll plaza.

- FASTag is affixed on front windscreen of the four wheeler.

- If you own more than one four wheeler, you will have to have separate FASTag for both the vehicles. You cannot use same FASTag for multiple vehicles.

- Once you have purchased a FASTag for a vehicle, it will be valid for 5 years. You can recharge the FASTag as per the requirement after the initial buying of the FASTag.

- FASTag can be recharged online through netbanking, UPI, debit cards, credit cards and paytm. Minimum amount to recharge FASTag is Rs100 and maximum amount is Rs 1,00,000.

- You should always buy FASTag from trusted banking partners only.

- You should never buy a FASTag from the company which asks to link your bank account. You should always used prepaid service for the FASTag.

What are the benefits of using FASTag?

The FASTag have many advantages for the for wheeler owners. The benefits of FASTag are listed below:

Cashless Payments

One of the best advantages by making FASTag compulsory is the tension of having an exact change at toll plazas. The transaction will be cashless and money will be automatically debited from your FASTag wallets.

Mobile Alerts through SMS

Whenever you will pass through any toll plaza, you will receive sms alerts on your registered mobile numbers when money will be deducted from FASTag. You will also receive alerts for low balance in your FASTag wallet.

Online Recharge

This is one of the best advantages of having FASTag. You can recharge it anytime using debit cards, net banking and UPI.

Faster Moving on Highway

Thus it also reduces the travelling time from one place to another as it will reduce human intervention saving your precious time.

Fee Charges of HDFC Bank FasTag Program

The Fee charges applicable on HDFC Bank FasTag are

- Tag Joining Fee (One-time Fee) is Rs.100/- ( including all applicable taxes)

- Reissuance Fees of Tag is Rs.100/- ( including all applicable taxes)

A one-time Security Deposit Amount can also be done as given below

- For Car / Jeep / Van / Tata Ace and Similar mini Light Commercial Vehicles Rs.200/- as the security deposit and Rs.100/- as the threshold amount.

- For Light Commercial vehicle 2-axle Rs.300 /- as security deposit and Rs.140/- as threshold amount.

- For Bus– 3 axle Rs.400/- as security deposit and Rs. 300/- as threshold amount.

- For Truck – 3 axle 500/- as security deposit and Rs. 300/- as threshold amount.

- For Bus 2 axle / Minibus, Truck 2 axle 400/- as security deposit and Rs. 300/- as threshold amount.

- For Tractor / Tractor with trailer, Truck 4, 5 & 6 -axle 500/- as security deposit and Rs. 300/- as threshold amount.

- For Truck 7-axle and above 500/- is a security deposit and Rs. 300/- as the threshold amount.

- For Earth Moving / Heavy Construction Machinery 500/- as the security deposit and Rs. 300/- as the threshold amount.

Required Documents for HDFC Bank FasTag

- Voter ID Card

- Driving License

- Pan Card

- Vehicle Registration documet

How to Apply Online for HDFC Bank FasTag

- HDFC FasTag can be taken in 3 easy steps

- Click on the HDFC Bank FasTag web portal link. Enter your details of customer ID, mobile number, and email Id, and verify your details by entering the OTP sent to your mobile number.

- On successful validation of the OTP, enter the new password in which you should enter for logging in to your HDFC FasTag account.

- Share your Vehicle registration details, upload the required documents mentioned above and review the application for any changes and submit your application.

- Pay the required amount and get your card at your doorstep.

| Author | HDFC |

| Language | English |

| No. of Pages | 4 |

| PDF Size | 1 MB |

| Category | PDF of Forms |

| Source/Credits | – |

Related PDFs

Tuition Fee Reimbursement Form PDF

HDFC Fastag Application Form PDF Free Download