‘GST Rates’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Complete List of Goods and Service Tax Rates’ using the download button.

New GST Rates List 2023 PDF Free Download

Goods and Service Tax (GST)

There has been much debate on GST tax rates recently amongst the trading community and the GST council.

The GST council of members has held several rounds of meetings to revise GST rates. The latest GST rates show a reduction of 6% to 18% in GST rates for various commodities across most categories.

GST is a tax levied for the consumption of goods and services. The tax is applied by the supplier of products and services while billing customers.

GST is a unified and simplified taxation system that replaced the earlier goods and services taxation system of VAT. GST is applied in a simplified structure along the supply chain.

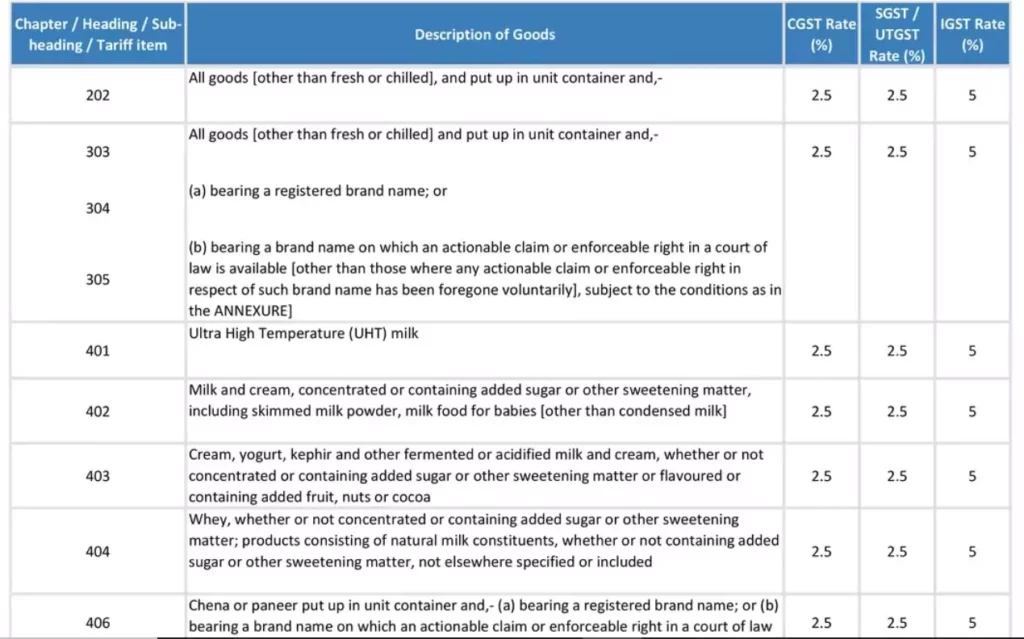

The GST rates for commonly-used consumable products are given in the below table

| Tax Rates | Products | |

| 0% | Milk | Kajal |

| 0% | Eggs | Educations Services |

| 0% | Curd | Health Services |

| 0% | Lassi | Children’s Drawing & Colouring Books |

| 0% | Unpacked Foodgrains | Unbranded Atta |

| 0% | Unpacked Paneer | Unbranded Maida |

| 0% | Gur | Besan |

| 0% | Unbranded Natural Honey | Prasad |

| 0% | Fresh Vegetables | Palmyra Jaggery |

| 0% | Salt | Phool Bhari Jhadoo |

| 5% | Sugar | Packed Paneer |

| 5% | Tea | Coal |

| 5% | Edible Oils | Raisin |

| 5% | Domestic LPG | Roasted Coffee Beans |

| 5% | PDS Kerosene | Skimmed Milk Powder |

| 5% | Cashew Nuts | Footwear (< Rs.500) |

| 5% | Milk Food for Babies | Apparel (< Rs.1000) |

| 5% | Fabric | Coir Mats, Matting & Floor Covering |

| 5% | Spices | Agarbatti |

| 5% | Coal | Mishti/Mithai (Indian Sweets) |

| 5% | Life-saving drugs | Coffee (except instant) |

| 12% | Butter | Computers |

| 12% | Ghee | Processed food |

| 12% | Almonds | Mobiles |

| 12% | Fruit Juice | Preparations of Vegetables, Fruits, Nuts, or other parts of Plants including Pickle Murabba, Chutney, Jam, Jelly |

| 12% | Packed Coconut Water | Umbrella |

| 18% | Hair Oil | Capital goods |

| 18% | Toothpaste | Industrial Intermediaries |

| 18% | Soap | Ice-cream |

| 18% | Pasta | Toiletries |

| 18% | Corn Flakes | Computers |

| 18% | Soups | Printers |

| 28% | Small cars (+1% or 3% cess) | High-end motorcycles (+15% cess) |

| 28% | Consumer durables such as AC and fridge | Beedis have NOT been included here |

| 28% | Luxury & sin items like BMWs, cigarettes, and aerated drinks (+15% cess) |

What are the new changes in GST?

On 13th July 2022, the Government of India issued nine Central Tax (Rate) notifications. These changes are applicable from 18th July 2022. Below are the new changes which are done in the council meeting:

- New HSN Codes from 2022- Three notifications were issued to align HSN Codes.

- GST rates change to amend the inverted tax structure-

- For Textiles, GST increased to 12% with HSN codes 51, 52, 53, 54, 55, 56, 58, 60, 63, and 64 (woven as well as knitted fabrics, knitting, saree falls, embroidery works, curtains bed linen, home furnishings and also dyeing services).

- For Footwear with HSN code 64 valued at or below Rs.1,000 per pair.

- e-Commerce operators to pay GST for passenger transport and restaurant services-

Now e-Commerce operators will become liable to pay GST for the cab services, carrier services, etc provided for the transportation of passengers. Further, the transport of passenger service will also include omnibuses and other motor vehicles. Further, cloud kitchen e-commerce operators providing the supply of food will be liable to pay GST.

Other

- Other GST rate changes-

- ‘Carriages for disabled persons are exempted under HSN code 8713 earlier taxed at 12%. Later, the same notification was removed in respect of Information Technology software’ from entry 452P earlier charged 18% GST.

- ‘Governmental Authority or a Government Entity’ removed from serial 3 being construction services.

- Key changes are carried out to the description of goods chargeable to GST.

- Key changes are carried out to the description of goods exempt from GST.

- A concessional GST rate of 12% applies to HSN code chapter 4414 instead of earlier 44140000 covering wooden frames having paintings, photos, mirrors, etc. Also, a concessional GST rate of 12% applies to HSN code 7419 80 instead of earlier 741999 covering art ware related to brass, copper, or its alloys.

In order to correct the inverted tax structure, the exemption list was pruned and inverted tax rates were set.

What Becomes Costlier and Cheaper

| Description of goods or services | Old Rate | New Rate |

| Cut and Polished diamonds | 0.25% | 1.50% |

| Tetra Pack (Aseptic Packaging Paper) | 12% | 18% |

| Tar (From coal, or coal gasification plants, or producer gas plants and coke oven plants) | 5%/18% | 18% |

| Import of tablets called Diethylcarbamazine (DEC) free of cost for the National Filariasis Elimination Programme (IGST) | 5% | Nil |

| Import of particular defense items by private businesses or suppliers for end-consumption of Defence (IGST) | Applicable rates | Nil |

| Ostomy Appliances | 12% | 5% |

| Orthopedic appliances such as intraocular lenses, artificial parts of the body, splints and other fracture appliances, other appliances which are worn or carried, or body implants, to compensate for a defect or disability | 12% | 5% |

| Transport of goods and passengers by ropeways (with ITC of services) | 18% | 5% |

| Renting of truck or goods carriage including the fuel cost | 18% | 12% |

| Products | Tax Rates |

| Milk | 0% |

| Eggs | 0% |

| Curd | 0% |

| Lassi | 0% |

| Kajal | 0% |

| Educations Services | 0% |

| Health Services | 0% |

| Children’s Drawing & Coloring Books | 0% |

| Unpacked Foodgrains | 0% |

| Unpacked Paneer | 0% |

| Gur | 0% |

| Unbranded Natural Honey | 0% |

| Fresh Vegetables | 0% |

| Salt | 0% |

| Unbranded Atta | 0% |

| Unbranded Maida | 0% |

| Besan | 0% |

| Prasad | 0% |

| Palmyra Jaggery | 0% |

| Phool Bhari Jhadoo | 0% |

| Products | Tax Rates |

| Sugar | 5% |

| Tea | 5% |

| Packed Paneer | 5% |

| Coal | 5% |

| Edible Oils | 5% |

| Raisin | 5% |

| Domestic LPG | 5% |

| Roasted Coffee Beans | 5% |

| PDS Kerosene | 5% |

| Skimmed Milk Powder | 5% |

| Cashew Nuts | 5% |

| Footwear (< Rs.500) | 5% |

| Milk Food for Babies | 5% |

| Apparels (< Rs.1000) | 5% |

| Fabric | 5% |

| Coir Mats, Matting & Floor Covering | 5% |

| Spices | 5% |

| Agarbatti | 5% |

| Coal | 5% |

| Mishti/Mithai (Indian Sweets) | 5% |

| Life-saving drugs | 5% |

| Coffee (except instant) | 5% |

| Products | Tax Rates |

| Butter | 12% |

| Ghee | 12% |

| Computers | 12% |

| Processed food | 12% |

| Almonds | 12% |

| Mobiles | 12% |

| Fruit Juice | 12% |

| Preparations of Vegetables, Nuts Fruits, or other parts | 12% |

| Packed Coconut Water | 12% |

| Umbrella | 12% |

| Products | Tax Rates |

| Hair Oil | 18% |

| Capital goods | 18% |

| Toothpaste | 18% |

| Industrial Intermediaries | 18% |

| Soap | 18% |

| Ice-cream | 18% |

| Pasta | 18% |

| Toiletries | 18% |

| Corn Flakes | 18% |

| Soups | 18% |

| Computers | 18% |

| Printers | 18% |

| Products | Tax Rates |

| Small cars (+1% or 3% cess) | 28% |

| High-end motorcycles (+15% cess) | 28% |

| Consumer durables such as AC and fridge | 28% |

| Beedis are NOT included here | 28% |

| Luxury & sin items like BMWs, cigarettes | 28% |

| and aerated drinks (+15% cess) | 28% |

| Author | – |

| Language | English |

| No. of Pages | 165 |

| PDF Size | 5 MB |

| Category | PDF of Lists |

| Source/Credits | – |

Related PDFs

Voter List Assam 2023 with Photo PDF

New GST Rates List 2023 PDF Free Download