‘Final Accounts with Adjustments Notes’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Final Accounts With Adjustments Solved Problems PDF’ using the download button.

Preparation of Final Accounts with Adjustments PDF Free Download

Final Accounts with Adjustments Solved Problems

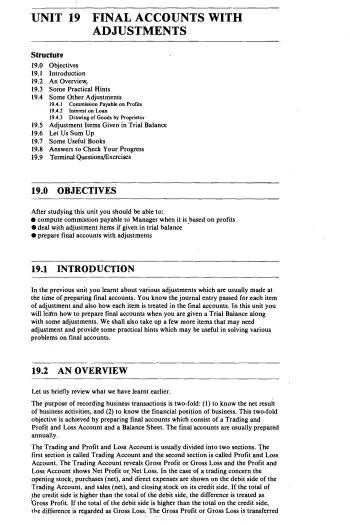

In the previous unit, you learned about various adjustments that are usually made at the time of preparing final accounts.

You know the journal entry passed for each item of adjustment and also how each item is treated in the final accounts. In this unit, you will learn how to prepare final accounts when you are given a Trial Balance along with some adjustments.

We shall also take up a few more items that may need adjustment and provide some practical hints that may be useful in solving various problems on final accounts.

The purpose of recording business transactions is two-fold: (1) to know the net result of business activities, and (2) to know the financial position of the business.

This two-fold objective is achieved by preparing final accounts which consist of a Trading and Profit and Loss Account and a Balance Sheet.

The final accounts are usually prepared annually. The Trading and Profit and Loss Account is usually divided into two sections. The first section is called Trading Account and the second section is called Profit and Loss Account.

The Trading Account reveals Gross Profit or Gross Loss and the Profit and Loss Account shows Net Profit or. Net Loss.

In the case of a trading concern the opening stock, purchases (net), and direct expenses are shown on the debit side of the Trading Account, and sales (net), and closing stock on its credit side. If the total of the credit side is higher than the total of the debit side, the difference is treated as ‘Gross Profit.

If the total on the debit side is higher than the total on the credit side, the difference is regarded as Gross Loss. The Gross Profit or Gross Loss is transferred to the Profit and Loss Account.

In the case of manufacturing concerns, we also prepare a Manufacturing Account.

The purpose of preparing the Manufacturing Account is to ascertain the Cost of Goods Manufactured and the same is transferred to the Trading Account.

The Profit and Loss Account is prepared to find out the Net Profit or Net Loss.

The Gross Profit transferred from the Trading Account is shown on the credit side of the Profit and Loss Account and the indirect expenses and revenue losses are on its debit side.

If there are some other gains, they are also shown on its credit side.

The Profit and Loss Account will generally show a credit balance which represents Net Profit. But, if it shows a debit balance, it means there is a Net Loss.

The Net Profit or Net Loss is transferred to the Capital Account of the proprietor. In the Balance Sheet, all assets are shown on the right-hand side, and all liabilities including the capital on the left-hand side. The totals on two sides of the Balance Sheet must tally.

At the time of preparing the final accounts, we also have to make adjustments in respect of various items to arrive at the true profit or loss and the true financial position So far you have learned how to deal with various adjustments in the final accounts when they are given outside the Trial Balance.

Every adjustment is shown at two places in the final accounts to complete the double entry.

Sometimes, you may find that a few adjustment items such as Depreciation, Outstanding Expenses, Prepaid Expenses, Outstanding Incomes, etc., are given in the Trial Balance itself and not shown as adjustments outside the Trial Balance.

This happens when their adjusting entries have already been passed and their postings are made in the concerned accounts in the ledger.

You know when an adjusting entry is passed, one aspect is posted to an existing account and for the other aspect, a new account has to be opened in the books.

For example, when you make a journal entry for depreciation on machinery you debit the Depreciation Account and credit the Machinery Account.

The Machinery Account already exists in the ledger and the amount of depreciation is posted to its credit side. But, the Depreciation Account does not exist in the ledger.

It will be a new account to which the amount will be debited. Similarly, when you pass a journal entry for outstanding salaries, you debit the Salaries Account ! and credit the Outstanding Salaries Account.

The Salaries Account already exists in the ledger but you have to open the Outstanding Salaries Account before posting can be done. If the postings have been made, the balances of such new accounts will now appear in the Trial Balance.

| Author | – |

| Language | English |

| No. of Pages | 21 |

| PDF Size | 0.8 MB |

| Category | Account |

| Source/Credits | egyankosh.ac.in |

Gujarati Income Tax Accounts PDF

Final Accounts with Adjustments Ignou And NIOS Material PDF Free Download