‘Union Bank Of India Loan For MSME Application Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Union Bank Of India Loan For MSME Application Form’ using the download button.

Union Bank Of India Loan For MSME Application Form PDF Free Download

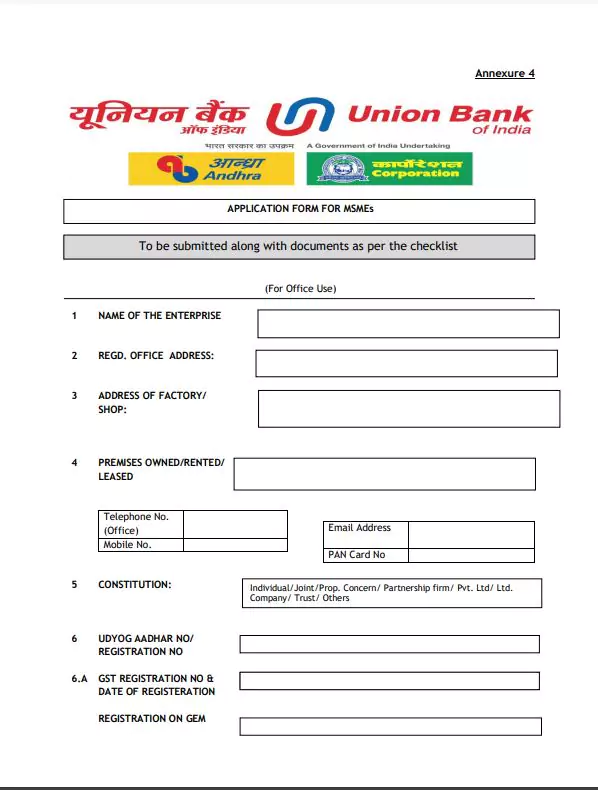

Union Bank Of India Loan For MSME Application Form

The Union Bank of India offers various types of retail and MSME loans at an interest rate starting from 8.20% p.a.

The maximum loan amount offered is up to Rs. 25 crores (may exceed) with a repayment tenure of up to 10 years to MSMEs engaged in the trading, manufacturing, and service sectors.

Some of the key loan schemes offered by the Bank are Union Mudra, Union Trade Plus, Union Start-up, Union Liqui Property, and Union SME Plus along with several MSME loan schemes.

Union Bank of India – MSME Loan Schemes – 2023

| Name of Loan | Eligibility | Loan Quantum & Margin | Rate of Interest | Repayment |

| Union MUDRA – Composite Loan, Term-based Loan, Fund-based or Non-fund based Working Capital | Shishu – Maximum loan up to INR 50,000Kishore – Loans from INR 50,000 to INR 5,00,000Tarun – Loans between INR 5,00,000 to INR 10,00,000Margin – For loans in the ‘Shishu’ category, the margin is 5%For loans in ‘Kishore’ and ‘Tarun’ category, the margin is 10% | For working capital, the repayment period is 12 months. Term loans are to be paid within 84 months in monthly installments across a moratorium period of 6 months. | Micro Business enterprises in manufacturing, trade, and the service sector also including professionals such as CAs, ICWA, architects, or doctors. | Loan amounts from a minimum of INR 10 lakh to INR 10 crore.Margin based on the value of property – 50% |

| Union LIQUI Property – Term-based Loan, Overdraft Loan | 1. All business enterprises.2. Units with statutory requirements.3. Credit rating not below UBI-5 and UBI-4 (applicable to takeover advances)4. New and old accounts.5. Businesses in speculative activities or real estate activities are not eligible | For amounts of up to INR 5 crores, more than 5 crores, and rates of interest in all categories from CR-1 to CR-5 | From 9.70% onwards (Will depend on the credit ratings of the MSMEs) | While term loans can be repaid within 120 months with a moratorium period of 6 months, the overdraft facility is available for 1 year, subject to extension by the competent authority. |

| Union Trade Plus – Working capital and term loan. | 1. Units engaged in trade.2. Business units with good market standing engaged in business activity for at least 1 year with income tax returns filed. | Loans of up to INR 10 crores.Margin – 20% for working capital or term loans. | Repayments on working capital are to be done on demand, while repayments on term-based loans can be up to 7 years with a moratorium period of a maximum of 6 months. | Rates of Interest on:Standby ad-hoc working capital FB– 1% above rate applicable with respect to credit ratingStandby ad-hoc working capital NFB- Rates as applicable standby term-based loans- Rates applicable as per the credit rating. |

| Union Start-up | For working capital, the repayment period is up to 12 months.For term loans, a repayment period of 10 years inclusive of a moratorium period of not more than 36 months. | Loans from a minimum of INR 10 lakh up to INR 5 crore.Margin – 20% | 8.20% onwards | Unit needs to be certified as a start-up as per the Start-up India Scheme launched by the Government of India. Collaterals are not mandatory, but a guarantee of promoter directors and partners of firm/company. |

| Union SME Plus | Unit needs to be certified as a start-up as per the Start-up India Scheme launched by the Government of India. Collaterals are not mandatory, but a guarantee of promoter directors and partners of the firm/company. | For both Standby Ad-hoc and term loans, finance of up to 2.5 crores is available.Margin for working capital – 25%Margin for term loan – 25% | Repayments on working capital should be adjusted up to 3 months. Repayments for term-based loans can be performed up to 60 months including the moratorium period that is not more than 6 months. | Repayments on working capital should be adjusted up to 3 months. Repayments for term-based loans can be performed up to 60 months including the moratorium period which is not more than 6 months. |

Types of Union Bank MSME Loans – 2023

Union Bank of India offers a variety of business loans as per clients’ needs. Some of the popular Union Bank MSME loan schemes are discussed below:

1. Union Start-Up

- This scheme is for the “Start-up” units to support them in innovating, producing, and commercializing new products or services driven by technology or intellectual property as per the Start-up India Scheme

- Loan amount varies between Rs. 10 Lakhs to Rs. 5 Crore

- Collateral is not necessary

- No processing charges will be levied

- The loan can be availed as working capital or term loan

- The repayment period of working capital is 12 months

2. Union Liqui Property

- The interest rate offered under this scheme is 9.70% p.a. onwards

- This loan is applicable for all business firms carrying out business operations for at least a period of 2 years. Individuals, HUF, and firms involved in Real Estate and other speculative activities cannot apply for the scheme

- Applicants must have the expected credit score.

- Firms should have all the needful statutory approvals/NOCs from respective authorities

- The loan amount can range from Rs. 10 lakh to Rs. 10 crore. The amount can be used in the purchase of equipment, and machinery, meeting up working capital for daily requirements, or clearing high debts

- Maximum loan tenure is 10 years including a moratorium period of up to 6 months. Moreover, the interest is to be paid as and when due

- Collateral and guarantee are mandatory

- The loan can be availed as a term loan as well as an overdraft facility

3. Union High Pride

- Other than trading units, this loan is available for all MSME units involved in manufacturing or service operations for at least 1 financial year and income tax returns should have been submitted thereof

- The credit rating of the account must be as per the guidelines

- Loan quantum ranges between Rs. 1 crore to Rs. 25 crore

- The loan repayment period is as per the extant norms prescribed in the loan policy of the bank

- The rate of interest applicable:

- 1% less than the applicable rate for MSME subject to minimum applicable MCLR

- 25% less than the applicable rate for MSME subject to minimum applicable MCLR on compliance with any of the following conditions:

- External credit rating of BBB and above

- 100% and above collateral coverage

| Language | English |

| No. of Pages | 8 |

| PDF Size | 0.36 MB |

| Category | Form |

| Source/Credits | www.unionbankofindia.co.in |

Related PDFs

HDFC Loan Application Form PDF

YES Bank Loan Application Form PDF

PNB Application Form For Home Loan PDF

PNB Application Form For Personal Loan PDF

Axis Bank Personal Loan Application Form PDF

Axis Bank Home Application Form PDF

Union Bank Of India Loan For MSME Application Form PDF Free Download