‘Declaration for Deduction of Tax under Section 194Q’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘TDS Declaration Form’ using the download button.

TDS Declaration Form PDF Free Download

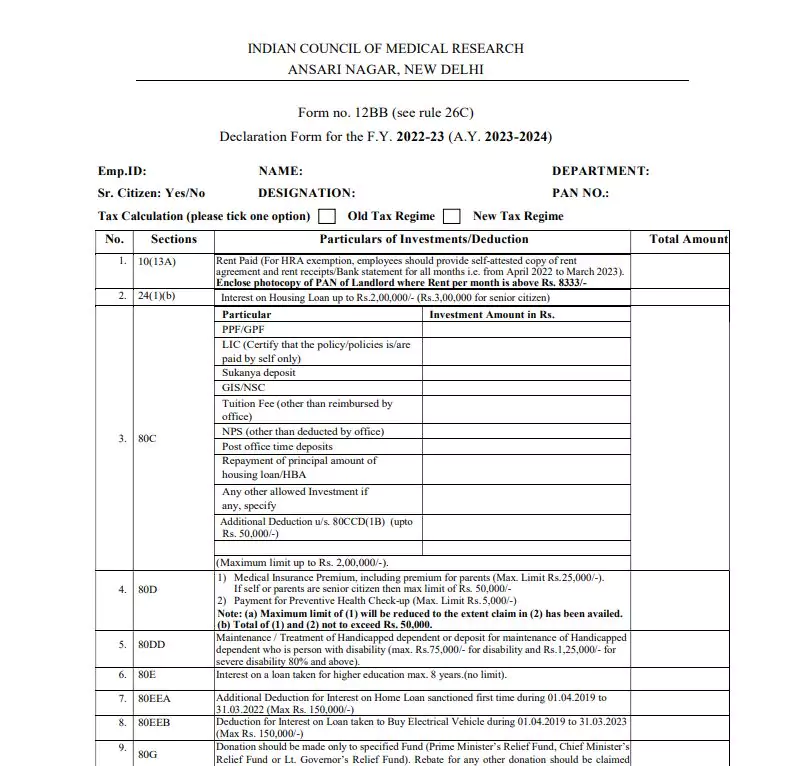

TDS Declaration Form

The Finance Act, 2021 has introduced a new Section- Sec. 206AB.

This is a Special Provision for deduction of tax at source for non-filers of income tax return.

This Section shall come into effect from 01st July, 2021. The purpose behind introducing this Section is to ensure maximum income tax coverage and compliance.

The Government wants to encourage people to file their income tax returns on time and penalize those who do not comply by bringing in such strict provisions. Now, in order to comply with the new provisions, the deductor will require a Declaration regarding filing/non-filing of Income Tax Returns from the deductee.

Also, evidence of Income Tax Return filing will be required from the deductee. In case of a Proprietor/Firm/LLP/Company or HUF, such declaration will have to be given on the letter-head of the entity.

Accordingly, we have hereby provided a Draft Declaration (below) which can be used by the deductee for submission with the deductor- Format of Declaration for not imposing TDS Rate as per Section 206AB of the Income Tax Act, 1961 To Whom So Ever It May Concern Declaration form for not imposing TDS Rate as per Sec. 206AB of the Income Tax Act I/We, ________________, having Permanent Account Number ________________, am/are resident in India and hereby declare as follows:

1. I/We have filed my/our Return of Income for the preceding Financial Year 2018-19 relevant to the Assessment Year 2019-20. The date of filing is ___________ and the Acknowledgement Number issued by the Income Tax Department evidencing the filing of the tax return is _____________. The copy of the screenshot of the ITR Acknowledgement evidencing the filing of the above tax return is

2. I/We have filed my/our Return of Income for the preceding Financial Year 2019-20 relevant to the Assessment Year 2020-21. The date of filing is ___________ and the Acknowledgement Number issued by the Income Tax Department evidencing the filing of the tax return is ______________. The copy of the screenshot of the ITR Acknowledgement evidencing the filing of the above tax return is

3. This point is applicable only if a tax return has not been filed as stated above: Where I/We have not filed my Return of Income for both the preceding two Financial Years 2019-20 and 2020-21, I/We hereby confirm that the aggregate tax deducted and tax collected at source is /is not Rs. 50,000/- or more in each of the two preceding Financial Years 2019-20 and 2020-21.

4. I/We hereby declare that I/we am/are duly authorized to give this declaration and the information stated above is true to the best of my/our knowledge and belief. If there is any misdeclaration, I/we undertake to indemnify you/your organisation; for any interest or any penal consequences. (Signature)

| Author | TDS |

| Language | English |

| No. of Pages | 4 |

| PDF Size | 1 MB |

| Category | Form |

| Source/Credits | main.icmr.nic.in |

Related PDFs

मुख्यमंत्री कन्या विवाह योजना फॉर्म 2023 PDF

Form XVIII B Bihar PDF In Hindi

TDS Declaration Form PDF Free Download