‘PMSBY Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Pradhan Mantri Suraksha Bima Yojana (PMSBY)’ using the download button.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) PDF Free Download

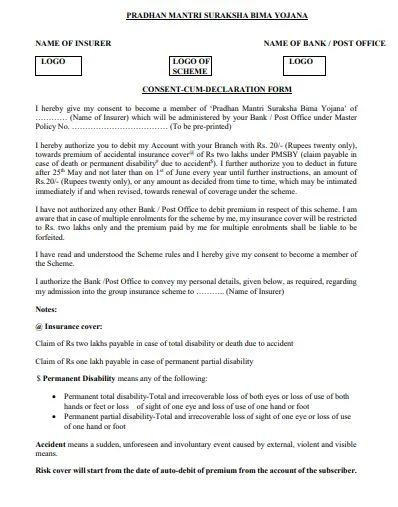

PMSBY Form PDF

DETAILS OF THE SCHEME:

PMSBY is an Accident Insurance Scheme offering accidental death and disability cover for death or disability on account of an accident. It would be a one-year cover, renewable from year to year.

The scheme would be offered / administered through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies willing to offer the product on similar terms with necessary approvals and tie up with Banks / Post office for this purpose.

Participating banks / Post office will be free to engage any such insurance company for implementing the scheme for their subscribers.

Scope of coverage:

All individual bank/ Post office account holders in the age group of 18 to 70 years in participating banks/ Post office will be entitled to join.

In case of multiple bank/ Post office accounts held by an individual in one or different banks/ Post office, the person would be eligible to join the scheme through one bank / Post office account only.

Aadhar would be the primary KYC for the bank/ Post office account.

Enrolment Modality / Period:

The cover shall be for the one-year period stretching from 1st June to 31st May for which option to join / pay by auto-debit from the designated bank/ Post office account on the prescribed forms will be required to be given by 31st May of every year.

Joining subsequently on payment of full annual premium would be possible.

However, applicants may give an indefinite / longer option for enrolment / auto-debit, subject to continuation of the scheme with terms as may be revised on the basis of past experience.

Individuals who exit the scheme at any point may re-join the scheme in future years through the above modality.

New entrants into the eligible category from year to year or currently eligible individuals who did not join earlier shall be able to join in future years while the scheme is continuing.

Benefits:

As per the following table: Table of Benefits Sum Insured a Death Rs. 2 Lakh b Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot Rs. 2 Lakh c Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot Rs. 1 Lakh

Premium: Rs. 20/- per annum per member.

The premium will be deducted from the account holder’s bank/ Post office account through ‘auto debit’ facility in one instalment on or before 1 st June of each annual coverage period under the scheme.

However, in cases where auto debit takes place after 1st June, the cover shall commence from the date of auto debit of premium by Bank/ Post office. The premium would be reviewed based on annual claims experience.

Eligibility Conditions:

Individual bank/ Post office account holders of participating banks/ Post office aged between 18 years (completed) and 70 years (age nearer birthday) who give their consent to join / enable auto-debit, as per the above modality, will be enrolled into the scheme.

Master Policy Holder:

Participating Bank/ Post office will be the Master policy holder on behalf of the participating subscribers.

A simple and subscriber friendly administration & claim settlement process has been finalized by the respective general insurance company in consultation with the participating Banks.

Termination of cover:

The accident cover for the member shall terminate on any of the following events and no benefit will be payable there under:

1) On attaining age 70 years (age nearest birthday).

2) Closure of account with the Bank/ Post office or insufficiency of balance to keep the insurance in force.

3) In case a member is covered through more than one account and premium is received by the Insurance Company inadvertently, insurance cover will be restricted to one bank/ Post office account only and the premium paid for duplicate insurance(s) shall be liable to be forfeited.

4) If the insurance cover is ceased due to any technical reasons such as insufficient balance on due date or due to any administrative issues, the same can be reinstated on receipt of full annual premium, subject to conditions that may be laid down.

During this period, the risk cover will be suspended and reinstatement of risk cover will be at the sole discretion of Insurance Company.

5) Participating banks will deduct the premium amount in the same month when the auto debit option is given, preferably in May of every year, and remit the amount due to the Insurance Company in that month itself.

Administration:

The scheme, subject to the above, will be administered as per the standard procedure stipulated by the Insurance Company.

The data flow process and data proforma will be provided separately.

It will be the responsibility of the participating bank/ Post office to recover the appropriate annual premium from the account holders within the prescribed period through ‘auto-debit’ process.

| Language | English |

| No. of Pages | 3 |

| PDF Size | 0.2 MB |

| Category | Government |

| Source/Credits | jansuraksha.gov.in |

Alternate Source – PMSBY form pdf Union Bank of India

PMSBY form pdf bank of maharashtra

Pradhan Mantri Suraksha Bima Yojana (PMSBY) PDF Free Download