‘ICICI Bank RTGS Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘ICICI Bank NEFT Form’ using the download button.

Fillable ICICI Bank RTGS Form/ NEFT Application Form 2022 PDF Free Download

What is RTGS?

The acronym ‘RTGS’ stands for Real-Time Gross Settlement. Simply put, it is the process of continuous (real-time) settlement of funds, which occurs individually, on an order-by-order basis, without netting.

In other words, your request to transfer or settle funds is carried out immediately, instead of the same happening in batches (as is the case in NEFT).

‘Real Time’ indicates that the processing of instructions happens at the time they are received rather than at some later time. ‘Gross Settlement’ indicates that the settlement of fund transfer instructions occurs individually (on an instruction-by-instruction basis).

Considering that the settlement of funds takes place in the books of the Reserve Bank of India, the payments made through RTGS are final and irrevocable.

What is NEFT?

The National Electronic Funds Transfer (NEFT) is an electronic payment system that facilitates direct one-to-one payments across the country.

Using this facility, you can electronically transfer funds from any bank branch to any individual having an account with any other bank branch in the country that is a part of the NEFT scheme. You can also make NEFT transfers using digital modes of internet banking and mobile banking

EFT Transaction Charges

For digital channels:

No transaction charge is applicable on NEFT/RTGS transfers that are initiated through digital modes of banking, i.e. Internet Banking, iMobile app, Mera iMobile app, and Pockets app.

For Branches:

The below transaction charges are applicable for NEFT transfers that is initiated through the branches of ICICI Bank.

| Transaction Charges | NEFT |

|---|---|

| Up to ₹ 10,000 | ₹ 2.25 + Applicable GST |

| Above ₹ 10,000 and upto ₹ 1 lakh | ₹ 4.75 + Applicable GST |

| Above ₹ 1 lakh and upto ₹ 2 lakh | ₹ 14.75 + Applicable GST |

| Above ₹ 2 lakh and upto ₹ 10 lakh | ₹ 24.75 + Applicable GST |

As per RBI guidelines, National Electronic Funds Transfer (NEFT) is available 24×7 with effect from Dec 16, 2019.

RTGS/IMPS

| Transaction Limits/Timing | RTGS Monday to Saturday (Except 2nd and 4th Saturday) | IMPS (24 * 7 – 365 days) | |||

|---|---|---|---|---|---|

| iMobile | Internet | ||||

| Account number + IFSC | Mobile Number + MMID | Account number + IFSC | Mobile number + MMID | ||

| Minimum | ₹2 Lakh | Re. 1 | Re. 1 | Re. 1 | Re. 1 |

| Maximum | ₹10 Lakhs | ₹2lakh* | ₹10,000 | ₹2lakh | ₹10,000 |

*Upto ₹5 lakhs per transaction for IMPS (₹20 Lakhs per day through iMobile Pay)

NEFT(RIB & iMobile)

| Transaction Limits/Timing | 01.00 h₹– 19.00 h₹ | 00.00 h₹– 01.00 h₹ and 19.00 h₹– 00.00 h₹ | 2nd & 4th Saturday, Sunday & RTGS Holidays |

|---|---|---|---|

| Minimum | Re. 1 | Re. 1 | Re. 1 |

| Maximum | ₹10 Lakh or 25 Lakh (Based on customer segment) | ₹2 Lakh | ₹2 Lakh |

CIB, Instabiz & API Banking – Limits are at the user level

| Limits | 01:00 h₹– 19:00 h₹ | 00:00 h₹– 01:00 h₹and 19:00 h₹– 00:00 h₹ | 2nd & 4th Saturday, Sunday & RTGS Holidays |

|---|---|---|---|

| Total Transaction Amount | Existing Workflow limit mapped to Corporate | Maximum ₹ 10 Lakh | Maximum ₹ 10 Lakh |

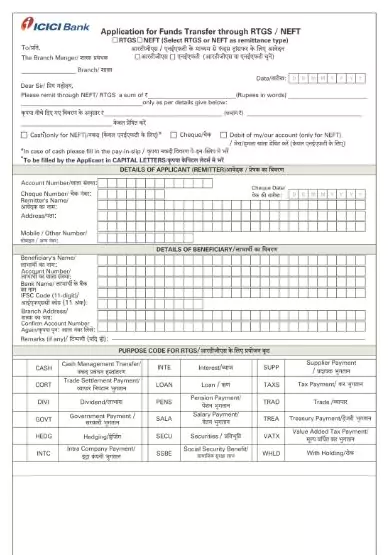

How to Fill ICICI Bank RTGS/NEFT Form?

The ICICI Bank RTGS form consists of several sections that need to be filled in and read the instructions.

- Start with filling in general details such as branch name and date.

- Enter the Amount to be remitted, Remitting the customer’s account number, which is to be debited,

- Now fill in the beneficiary account details. Name, bank name, bank IFSC code, account number, mobile number, and amount.

- Enter the check number if you are paying using the check. Sign your form in the space below.

Real-Time Gross Settlement.

National Electronic Fund Transfer

| Author | ICICI Bank |

| Language | English |

| No. of Pages | 2 |

| PDF Size | 0.1 MB |

| Category | Form PDF |

| Source/Credits | icicibank.com |

ICICI Bank RTGS/NEFT Form 2022 PDF Format Download Free