‘CFA Program Mock Exam And Practice Questions’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘CFA Exam Mock Exams Level III’ using the download button.

Level III Questions bank CFA Institute PDF Free Download

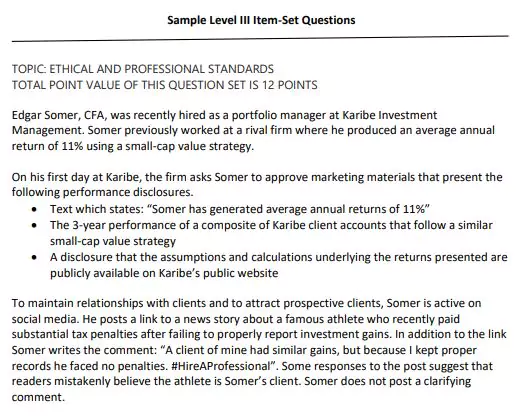

CFA Level 3

Q.1 To best comply with the CFA Institute Standards of Professional Conduct (the Standards) related to performance presentation, Somer should modify the:

- A. text regarding Somer’s investment returns.

- B. presentation of the performance for Karibe’s representative composite.

- C. content of the disclosure statement related to assumptions and calculations.

Answer: A

A is correct because Somer’s returns are not clearly explained as being generated at his prior firm.

If a firm is not claiming GIPS compliance, “Members and candidates can also meet their obligations under Standard III(D) by including disclosures that fully explain the performance being reported.”

B is incorrect because the marketing materials present the performance of a composite of similar portfolios.

C is incorrect because the materials direct prospective clients to the website where full disclosure of the assumptions and calculations are available.

Q.2 Does Somer’s social media post result in a violation of the Standards?

A. No

B. Yes, he violates the standard related to the preservation of confidentiality

C. Yes, he violates the standard related to communication with clients and prospective clients.

Answer: A

A is correct because Somer did not reveal the identity of his client (Standard III(E)).

The context of the comment (he helped his client avoid penalties) contradicts the mistaken conclusion of the readers of the social media post (the athlete in question had to pay penalties so obviously was not his client).

He also does not violate the standard related to communication (Standard V(B)) because it applies to 1) disclosure of the format and general principles of the investment process; 2) significant limitations and risks of the investment process; 3) identifying important factors for their analysis and recommendations, and 4) distinguishing between fact and opinion in investment analyses and recommendations.

His post did not relate to any of these and thus is not a potential violation of the standard.

B is incorrect because Somer does not violate the standard related to confidentiality because the athlete in the news story is not his client, and the information that he helped his own client avoid tax penalties by keeping good records does not provide enough information to disclose the client’s identity.

C is incorrect because Somer does not violate the standard related to communication (Standard V(B)) because it applies to 1) disclosure of the format and general principles of the investment process; 2) significant limitations and risks of the investment process; 3) identifying important factors for their analysis and recommendations; and 4) distinguishing between fact and opinion in investment analyses and recommendations.

His post did not relate to any of these and thus is not a potential violation of the standard, but certain candidates and/or exam team writers who think that communications with clients include a duty to correct everyone who misunderstands you may choose this answer.

Q.3 When preparing the marketing materials for the quantitative strategy, did Somer comply with the standard related to communication with clients and prospective clients?

A. Yes

B. No, because he did not identify the risk of coding errors

C. No, because he did not describe the investment process in detail

Answer: A

A is correct because he did not violate Standard V(B). With respect to informing clients of the investment process, the guidance stipulates that when explaining the process one “need not describe the investment system in detail… but must inform clients of (the) basic process and logic.”

The explanation of Somer’s process as factor-based with weights dynamically allocated meets this criterion. Regarding risk identification, “members and candidates cannot be expected to disclose risks they are unaware of at the time…. Having no knowledge of risk or limitation that subsequently triggers a loss may reveal a deficiency in the diligence and reasonable basis… but may not reveal a breach of Standard V(B).”

B is incorrect because “members and candidates cannot be expected to disclose risks they are unaware of at the time…. Having no knowledge of a risk or limitation that subsequently triggers a loss may reveal a deficiency in the diligence and reasonable basis… but may not reveal a breach of Standard V(B).”

C is incorrect because when explaining the process one “need not describe the investment system in detail… but must inform clients of (the) basic process and logic.” (Example 1 p. 141) The explanation of Somer’s process as factor-based with weights dynamically allocated meets this criterion.

Q.4 If he fills the client’s order for shares of the technology firm, would Somer violate the standard related to the priority of transactions?

A. No

B. Yes, because the client would be disadvantaged by the trade

C. Yes, because he would benefit personally from a trade undertaken for a client

Answer: C

C is correct because the guidance for Standard VI(B) specifies that “nothing is inherently unethical about… making money from personal investments as long as (1) the client is not disadvantaged by the trade, (2) the investment professional does not personally benefit from trades undertaken for clients, and (3) the investment professional complies with applicable regulatory requirements.”

In this case, Somer would personally benefit from a trade undertaken for a client by realizing a large gain and reducing the portfolio risk arising from his large position, which results in several potential conflicts of interest.

At a minimum, he would need to disclose to the client that he was filling the order from his own account and seek permission from Karibe to do so.

A is incorrect because Somer would personally benefit from a trade undertaken for a client by realizing a large gain and reducing the portfolio risk arising from his large position, which results in several potential conflicts of interest.

At a minimum he would need to disclose to the client that he was filling the order from his own account and seek permission from Karibe to do so.

B is incorrect because the client is not disadvantaged by the trade (and in fact gets the order filled at a discount to the prevailing market price).

| Author | – |

| Language | English |

| No. of Pages | 13 |

| PDF Size | 4 MB |

| Category | Education |

| Source/Credits | ift.world |

CFA Level 3 Mock Exam PDF Free Download