‘Accounting Ratios Class 12’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Accounting Ratios Class 12 All Formulas’ using the download button.

Accounting Ratios Class 12 All Formulas PDF Free Download

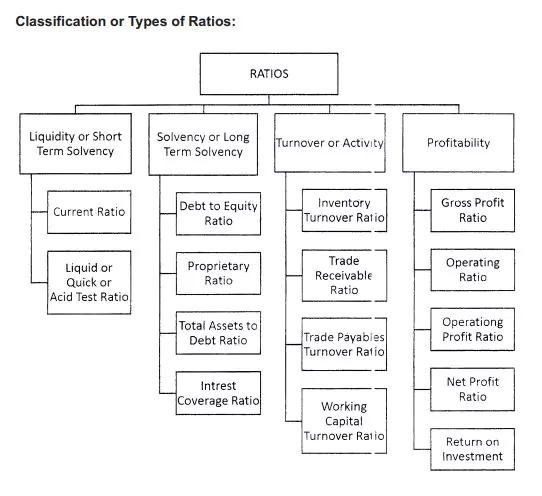

Accounting Ratios Chapter 4

Accounting Ratio: It is an arithmetical relationship between two accounting variables.

Ratio Analysis: It is a technique of analysis of financial statements to conduct a quantitative analysis of information in a company’s financial statements.

“Ratio analysis is a study of the relationship among various financial factors in a business.”

- Current Assets = Current Investments (also known as Market table Securities or S.T. Investment)

- Inventories (except Loose Tools & Stores and Spares)

- Trade Receivables (Debtors and B.R.) Net after provision for bdd.

- Cash and Cash Equivalents (Cash and Bank Balances)

- Short-Term Loans and Advances

- Other Current Assets (Prepaid Expenses, Accrued Income & Advance Tax)

- Current Liabilities = Short-Term Borrowings (Bank Overdraft and Cash Credit)

- Trade Payables (Creditors and B.P.)

- OtherCurrent Liabilities (O/s Expenses, Income Received in Advance, Unpaid or Ui claimed

Dividend) - Short-Term Provisions (Provision for Tax, Proposed Dividend)

- Liquid Assets = Current Assets

- Inventory (closing)

- Other Current assets (Prepaid Expenses, Accrued Income & Advance Tax)

- Working Capital = Current Assets – Current Liabilities

- Total Assets = Non-Current Assets + Current Assets

- Total Liabilities = Non-Current Liabilities + Current Liabilities

- Non-Current Assets = Fixed Assets (tangible and intangible)

- Non-Current Investments

- Long Term Loans & Advances (Capital Advances, Security Deposits)

- Non-Current Liabilities = Long Term Loans( Debentures, Bank Loans,Bonds)

- Long Term Provisions (Provision for employee benefit & Warranties)

- Capital Employed = Shareholders Fund

- Borrowed Fund (Non-Current Liabilities)

- Capital Employed = Total Assets – Current Liabilities = Non-Current Assets + Working Capital

- Shareholders Fund = Share Capital

- Reserves and Surplus Non-Current Non-Trade Investments

- Shareholders Fund = Total Assets – Non-Current Liabilities – Current/liabilities

| Author | – |

| Language | English |

| No. of Pages | 17 |

| PDF Size | 3.5 MB |

| Category | Education |

| Source/Credits | aspirationsinstitute.com |

Accounting Ratios Class 12 All Formulas Book PDF Free Download