‘List Of Toll Tax Exemption’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Latest Toll Tax Exemption List’ using the download button.

Toll Tax Exemption List PDF Free Download

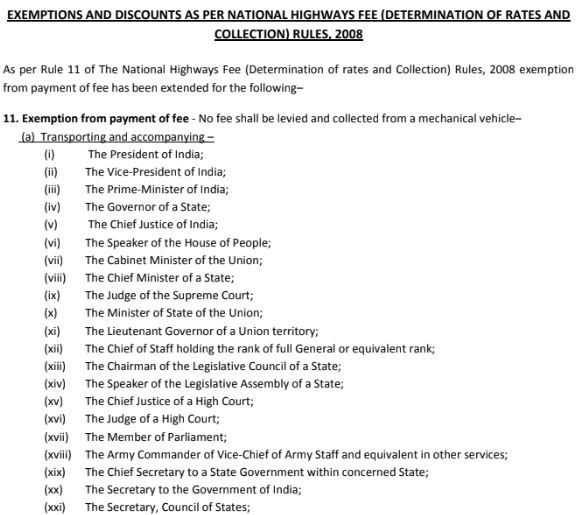

Toll Tax Exemption List

Exemption from payment of a fee – No fee shall be levied and collected from a mechanical vehicle.

(a) Transporting and accompanying

(i) The President of India;

(ii) The Vice-President of India;

(iii) The Prime Minister of India;

(iv) The Governor of a State;

(v) The Chief Justice of India;

(vi) The Speaker of the House of People;

(vii) The Cabinet Minister of the Union;

(viii) The Chief Minister of a State;

(ix) The Judge of the Supreme Court;

(x) The Minister of State of the Union;

(xi) The Lieutenant Governor of a Union territory;

(xii) The Chief of Staff holding the rank of full General or equivalent rank;

(xiii) The Chairman of the Legislative Council of a State;

(xiv) The Speaker of the Legislative Assembly of a State;

(xv) The Chief Justice of a High Court;

(xvi) The Judge of a High Court;

(xvii) The Member of Parliament;

(xviii) The Army Commander of Vice-Chief of Army Staff and equivalent in other services;

(xix) The Chief Secretary to a State Government within the concerned State;

(xx) The Secretary to the Government of India;

(xxi) The Secretary, Council of States;

(xxii) The Secretary, House of People;

(xxiii) The Foreign dignitary on a State visit;

(xxiv) The Member of the Legislative Assembly of a State and the Member of the Legislative Council of a State within their respective State, if he or she produces his or her identity card issued by the concerned Legislature of the State;

(xxv) The awardee of Pram Vir Chakra, Ashok Chakra, Maha Vir Chakra, Kirti Chakra, Vir Chakra, and Shaurya Chakra, if such awardee produces his or her photo identity card duly authenticated by the appropriate or competent authority for such award;

A person who owns a mechanical vehicle registered for non-commercial purposes and uses it as such for commuting on a section of the National Highway, permanent bridge,

bypass or tunnel may obtain a pass, on the payment of fees at the base rate for the year 2007-2008 of rupees one hundred and fifty per calendar month and revised annually by rule 5, authorizing it to cross the user fee plaza specified in such pass:

Provided that such pass shall be issued only if such driver, owner, or person in charge of a mechanical vehicle resides within 20 Kilometers from the user fee plaza specified by such person and the use of such section of national highway, permanent bridge, bypass or tunnel, as the case may be, does not extend beyond the user fee plaza next to the specified user fee plaza:

Provided further that no such pass shall be issued if a service road or alternative road is available.

(3A) A person who owns a mechanical vehicle (excluding vehicle plying under National Permit), registered with address on the Registration Certificate of a particular district and uses such vehicle for commuting on a section of the national highway, permanent bridge, bypass or tunnel, as the case may be, which is located within that distance, shall be levied user fee on all user fee plazas which are located within that district, at the rate of 50% of the prescribed rate of fee:

Provided further that no such pass shall be issued if a service road or alternative road is available.

| Author | – |

| Language | English |

| No. of Pages | 5 |

| PDF Size | 1 MB |

| Category | PDF of List |

| Source/Credits | drive.google.com |

Toll Tax Exemption List PDF Free Download