‘Practice Of General Insurance 4th Sem’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Practice Of General Insurance 4th Sem’ using the download button.

Practice Of General Insurance 4th Sem PDF Free Download

Practice Of General Insurance 4th Sem

The practice of General Insurance PDF 4th Sem – Principles of Insurance

In insurance, there are 7 basic principles that should be upheld, ie Insurable interest, Utmost good faith, proximate cause, indemnity, subrogation, contribution, and loss of minimization.

| S.N. | Principles | Details |

| 1. | Principle of Utmost Good Faith | This is a primary principle of insurance. According to this principle, you have to disclose all the information that is related to the risk, to the insurance company truthfully. You must not hide any facts that can have an effect on the policy from the insurer. If some fact is disclosed later on, then your policy can be canceled. On the other hand, the insurer must also disclose all the features of a life insurance policy. |

| 2. | Principle of Insurable Interest | According to this principle, you must have an insurable interest in the life that is insured. That is, you will suffer financially if the insured dies. You cannot buy a life insurance policy for a person on whom you have no insurable interest. |

| 3. | Principle of Proximate Cause | This is a primary principle of insurance. According to this principle, you have to disclose all the information that is related to the risk, to the insurance company truthfully.You must not hide any facts that can have an effect on the policy from the insurer. If some fact is disclosed later on, then your policy can be canceled. On the other hand, the insurer must also disclose all the features of a life insurance policy. |

| 4. | Principle of Subrogation | This principle comes into play when a loss has occurred due to some other person/party and not the insured. In such a case, the insurance company has a legal right to reach that party for recovery. |

| 5. | Principle of Indemnity | The principle of indemnity states that the insurance will only cover you for the loss that has happened. The insurer will thoroughly inspect and calculate the losses. The main motive of this principle is to put you in the same position financially as you were before the loss. This principle, however, does not apply to life insurance and critical health policies. |

| 6. | Principle of Contribution | While calculating the claim for a loss, the proximate cause, i.e., the cause which is the closest and the main reason for a loss should be considered. Though it is a vital factor in all types of insurance, this principle is not used in Life insurance. |

| 7. | Principle of Loss Minimisation | You must take all the necessary steps to limit the loss when it happens. You must take all the necessary precautions to prevent the loss even after purchasing the insurance. This is the principle of loss minimization. |

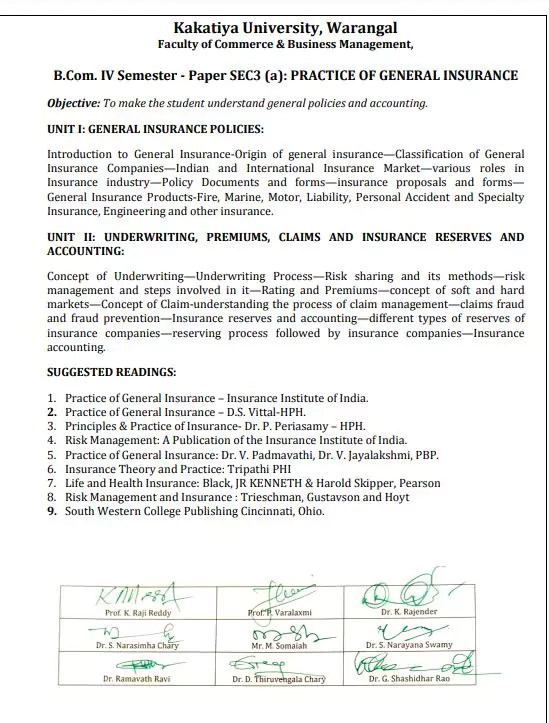

The Practice of General Insurance 4th Sem Syllabus

| Unit–I | |

| Sr.No. | Syllabus |

| PREMIUM CALCULATION AND POLICY DOCUMENTS: | |

| 1. | Meaning of Premium, Its Calculation – Rebates – Mode of Rebates |

| 2. | Large Sum Assured Rebates |

| 3. | Premium Loading |

| 4. | Rider Premiums |

| 5. | Computation of Benefits |

| 6. | Surrender Value |

| 7. | Paid up Value |

| 8. | General Insurance Policy Documents and Forms |

| 9. | Rating and Premiums |

| 10. | Concept of Soft and Hard Markets |

| Unit–II | |

| SETTLEMENT OF CLAIMS RISK & UNDERWRITINGS AND FINANCIAL PLANNING & TAX SAVING: | |

| 1. | Life Insurance |

| 2. | Settlement of Claims: Intimation Procedure, Documents and Settlement Procedures |

| 3. | Underwriting: The Need for Underwriting – Guiding Principles of Underwriting |

| 4. | Factors Affecting Insurability |

| 5. | Methods of Risk Classification |

| 6. | Laws Affecting Underwriting |

| 7. | Financial Planning and Taxation |

| 8. | Savings – Insurance Vis-A-Vis- Investment in the Units Mutual Funds |

| 9. | Capital Markets – Life Insurance in Individual Financial Planning |

| 10. | Implications in IT Treatment |

| 11. | General Insurance |

| 12. | Concept of Underwriting |

| 13. | Underwriting Process |

| 14. | Risk Sharing and its Methods |

| 15. | Risk Management and Steps Involved in it |

| 16. | Concept of Claim |

| 17. | Understanding the Process of Claim Management |

| 18. | Claims Fraud and Fraud Prevention |

| 19. | Insurance Reserves and Accounting |

| 20. | Different Types of Reserves of Insurance Companies |

| 21. | Reserving Process Followed by Insurance Companies |

| 22. | Insurance Accounting |

| Language | English |

| No. of Pages | 11 |

| PDF Size | 0.031 MB |

| Category | Education |

| Source/Credits | kakatiya.ac.in |

Related PDFs

Regulation Of Insurance Business PDF

BEGAE 182 Important Questions with Answers PDF

Vayana Dinam Quiz 2023 PDF In Malayalam

Practice Of General Insurance 4th Sem PDF Free Download