‘PM AtmaNirbhar Nidhi Scheme Loan Application Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘PM AtmaNirbhar Nidhi Scheme Loan Application Form’ using the download button.

PM AtmaNirbhar Nidhi Scheme Loan Application Form PDF Free Download

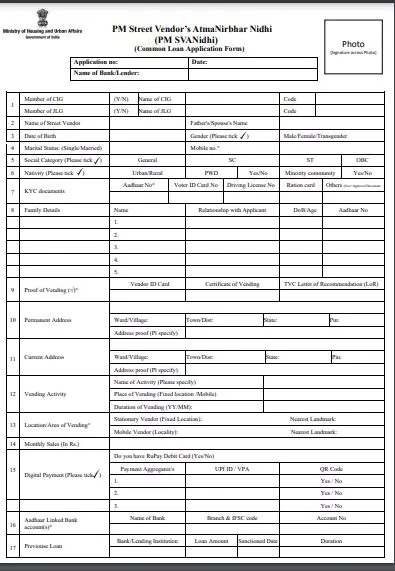

PM AtmaNirbhar Nidhi Scheme Loan Application Form

- To facilitate and provide working capital loans up to Rs.10,000 at a subsidized rate of interest,

- To incentivize regular repayment of the loan, and

- To reward digital transactions.

Eligibility Criteria Of PM Svanidhi Scheme

The PM Svanidhi scheme is available to every street vendor working in urban areas on or before 24 March 2020. The beneficiaries under this scheme will be identified according to the following criteria:

- Street vendors in possession of an Identity card or Certificate of Vending issued by Urban Local Bodies (ULBs).

- Street vendors identified in the survey but have not been issued the Certificate of Vending or Identity Card. In such cases, the Provisional Certificate of Vending will be generated for the street vendors.

- Street Vendors left out of the ULB-led identification survey or who have started vending after the completion of the survey but have been issued with the Letter of Recommendation (LoR) by the ULB or Town Vending Committee (TVC).

- Street vendors of the surrounding development or rural or peri-urban areas vending in the geographical limits of the ULB and have been issued with the Letter of Recommendation (LoR) by the ULB or TVC.

Benefits Under PM Svanidhi Scheme

The following are the benefits provided to the urban street vendors under the PM Svanidhi scheme:

Working Capital Loans

The urban street vendors can avail of a Working Capital (WC) loan of up to Rs.10,000 with a tenure of 1 year repaid in monthly installments.

No collateral is required to avail of this loan. On early or timely repayment of this loan, the street vendors will be eligible for the next cycle of the WC loan with an enhanced limit.

There is no charge of prepayment penalty for the repayment of the WC loan before the scheduled date.

Rate of Interest

In the case of Scheduled Commercial Banks, Small Finance Banks (SFBs), Regional Rural Banks (RRBs), Cooperative Banks, and SHG (self-help groups) Banks, the rate of interest will be as per their prevailing rates of interest.

In the case of Non-Banking Financial Companies (NBFC), Non-Banking Financial Company-Micro Finance Institutions (NBFC-MFIs), etc., the interest rates will be as per the RBI guidelines for the respective lender category.

In respect of MFIs (non-NBFC) and other lender categories that are not covered under the RBI guidelines, the interest rates would be applicable as per the extent of the RBI guidelines for NBFC-MFIs.

Interest Subsidy

The street vendors who avail of WC loans under the scheme can get an interest subsidy of 7%. The interest subsidy amount is credited to the borrower’s account quarterly. The interest subsidy is available up to 31 March 2022. The interest subsidy is available on the first and the subsequent enhanced loan up to that date.

| Language | English |

| No. of Pages | 2 |

| PDF Size | 0.05 MB |

| Category | Form |

| Source/Credits | – |

Related PDFs

Tamil Nadu Arms (Gun) Licence Application Form PDF

Moulvi Candidate Registration Application Form 2023 PDF

Assam Ration Card Application Form PDF Assamese

PM AtmaNirbhar Nidhi Scheme Loan Application Form PDF Free Download