‘NPS Form HDFC Bank’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘NPS Form HDFC Bank’ using the download button.

NPS Form HDFC Bank PDF Free Download

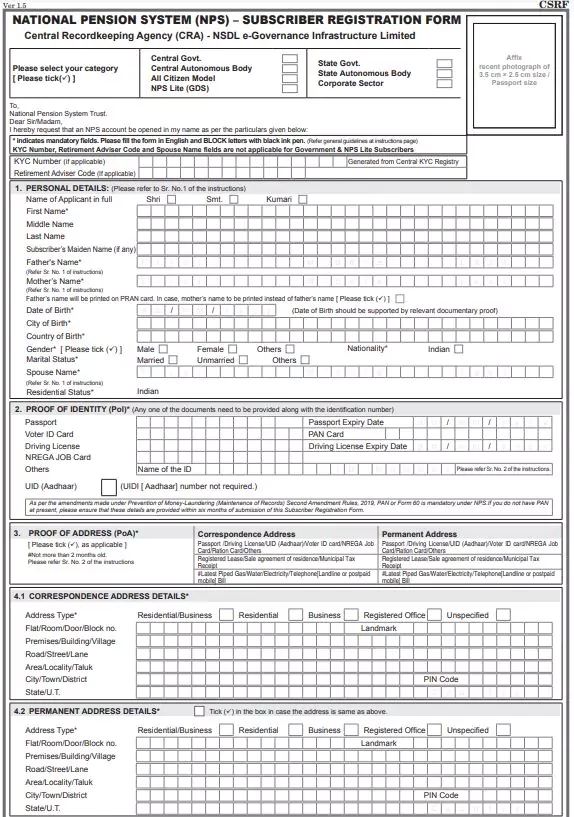

NPS Form HDFC Bank

There are various benefits that one can avail of through NPS when applied via HDFC Bank. Let us take a look at the features and benefits.

- Regulated – NPS is a scheme launched by the Pension Fund Regulatory and Development Authority (PFRDA) under the government of India.

- Tax Benefit – Save income tax up to Rs. 1.5 Lacs under Section 80C. One can also enjoy an additional deduction of Rs. 50,000 under Section 80CCD (1B).

- Minimal contribution – The minimum deposit you need to make for having an NPS account is just Rs. 500 per month or Rs. 6000 per year.

- Two accounts – NPS offers 2 types of accounts – Tier I and Tier II. Tier I is a mandatory investment and both differ in terms of money withdrawn from them. You are not allowed to withdraw money from a Tier I account till you retire. Even there are some limitations when you withdraw on retirement. On the other hand, there is no limit to withdrawal from a Tier II account. The subscriber can entirely withdraw the money from the Tier II account.

Risk assessment – since the NPS provides a 50% cap on equity exposure, it braces the risk-return equation for the investors. This keeps the corpus protected from the volatility of the equity market.

Eligibility Criteria for HDFC’s National Pension Scheme

NPS through HDFC Bank is open for any Indian citizen.

- The individual must be in the age group of 18 to 60

- The applicant must be KYC-compliant.

- The applicant must not have an existing NPS account.

A step-by-step guide to opening an NPS account through HDFC Bank

- If you are already a user of HDFC securities, log in using your trading id and password here

- If not, then create a new HDFC account to get access to the HDFC website.

- After login, click on the “online NPS” option.

- Fill up the form with your personal details and send it to the HDFC branch located near you along with your KYC documents attached.

- You will be asked to pay Rs. 500 during the application.

- When the bank confirms your KYC details, Permanent Retirement Account (PRA) is created, and a “Unique Permanent Retirement Account Number (PRAN)” will be allotted where an individual can have only 1 PRAN

| Language | English |

| No. of Pages | 7 |

| PDF Size | 1 MB |

| Category | Form |

| Source/Credits | – |

Related PDFs

Earned Leave Application Form Maharashtra Government Employees PDF In Marathi

HRA Declaration Form For School Teachers 2023 PDF

UP Government Caste Certificate Form PDF In Hindi

Navodaya Application Form For 6th Class 2023-24 PDF

Medical Reimbursement Form For Maharashtra Government Employees PDF

NPS Form HDFC Bank PDF Free Download