‘GST HSN & SAC Code List’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘GST HSN Code List’ using the download button.

GST HSN Code List PDF Free Download

List Of HSN And SAC Code

| HS CODE | DESCRIPTION |

| 0101 | Live horses, asses, mules, and hinnies. |

| 0101 2100 | Pure-bred breeding animals |

| 0101 29 | Others; |

| 0101.29.10 | Horses for polo |

| 0101 30 | Asses |

| 2815 | Sodium hydroxide (caustic soda); potassium hydroxide (caustic potash); peroxides of sodium or potassium. |

| 2815.11 | solid |

| 2815.11.10 | Flakes |

| 2816 | Hydroxide and peroxide of magnesium; oxides, hydroxides and peroxides, of strontium or barium. |

| 3204.14 | Direct dyes and Preparations based thereon |

| 3204.15 | Vat dyes (including those usable in that state as pigments) and Preparations based thereon |

| 3204.16 | Reactive dyes and Preparations based thereon |

| 7010 | Carboys, bottles, flasks, jars, pots, phials, ampoules and other containers, of glass, of a kind used for the conveyance or packing of goods; preserving jars of glass; stoppers, lids and other closures, of glass |

| 7011 | “Glass envelopes (including bulbs and tubes), open, and glass parts thereof, without fittings, for electric lamps and light sources, cathode ray tube or the like |

| 7013 | Glassware of a kind used for table, kitchen, toilet, office, indoor decoration or similar purposes (other than that of heading 7010 or 7018) |

| 7014 | Signaling glassware and optical elements of glass (other than those of heading 7015), not optically worked |

| 7015 | Clock or watch glasses and similar glasses, glasses for non-corrective spectacles, curved, bent, hollowed or the like, not optically worked; hollow glass spheres and their segments, for the manufacture of such glasses |

| 7016 | Paving blocks, slabs, bricks, squares, tiles, and other articles of pressed or molded glass, whether or not wired, of a kind used for building or construction purposes; glass cubes and other glass smallwares, whether or not on a backing, for mosaics or similar decorative purposes; leaded lights and the like; multi-cellular or foam glass in blocks, panels, plates, shells or similar forms |

For taxpayers with turnover between Rs 1.5 Crores and Rs 5 Crores in the preceding financial year, HSN codes need to be specified only at the 2-digit chapter level.

HSN code of 4 digits will be mandatory for taxpayers having a turnover of more than 5 crores.

Turnover will be taken on a self-declaration basis for the 1st year and afterward turnover of the previous year shall be used.

HSN codes at 8 digits will be mandatory in case of export and imports as the GST law has to be compatible with international standards.

What are HSN codes?

- HSN or HS (Harmonized Commodity Description and Coding System) is developed by World Customs Organization (WCO).

- All goods are classified based on these codes.

- It is an internationally accepted product coding system.

- Presently in India this system is used for classification of goods under Customs and Central Excise since 1985.

- This system is would continue under the GST regime as well.

GST HSN Code Chapter Wise list

| Name of Chapter | GST HSN Codes |

| Chapter 1 | Live Animals, Bovine & Poultry |

| Chapter 2 | Meat & Edible Offal of Animals |

| Chapter 3 | Fish Meat & Fillets |

| Chapter 4 | Eggs, Honey & Milk Products |

| Chapter 5 | Non-Edible Animal Products |

| Chapter 6 | Live Trees & Plants |

| Chapter 7 | Vegetables |

| Chapter 8 | Fruits & Dry Fruits |

| Chapter 9 | Tea, Coffee & Spices |

| Chapter 10 | Edible Grains |

| Chapter 11 | Milling Industry Products |

| Chapter 12 | Oil Seeds, Fruit & Part of Plants |

| Chapter 13 | Gums, Resins, Vegetable SAP & Extracts |

| Chapter 14 | Vegetable Material & Products |

| Chapter 15 | Fats, Oils & Waxes their Fractions |

| Chapter 16 | Preserved/Prepared Food Items |

| Chapter 17 | Sugar, Jaggery, Honey & bubble Gums |

| Chapter 18 | Chocolate & Cocoa Products |

| Chapter 19 | Pizza, Cake, Bread, Pasta & Waffles |

| Chapter 20 | Edible Plants – Fruits, Nuts & Juices |

| Chapter 21 | Tea & Coffee Extract & Essence |

| Chapter 22 | Water, Mineral & Aerated |

| Chapter 23 | Flours, Meals & Pellets |

| Chapter 24 | Tobacco, Stemmed & Stripped |

| Chapter 25 | Salts & Sands |

| Chapter 26 | Mineral Ores & Slags |

| Chapter 27 | Fossil Fuels – Coal & Petroleum |

| Chapter 28 | Gases & Non-Metals |

| Chapter 29 | Hydrocarbons – Cyclic & Acyclic |

| Chapter 30 | Drugs & Pharmaceuticals |

| Chapter 31 | Fertilizers |

| Chapter 32 | Tanning & Colouring Products |

| Chapter 33 | Essential Oils, Beauty Products |

| Chapter 34 | Soaps, Waxes, Polish products |

| Chapter 35 | Casein, Albumin, Gelatin, Enzymes |

| Chapter 36 | Propellants, Explosives, Fuses, Fireworks |

| Chapter 37 | Photographic & Cinematographic Films |

| Chapter 38 | Insecticides, Artificial Carbon & Graphite |

| Chapter 39 | Polymers, Polyethylene, Cellulose |

| Chapter 40 | Rubber, Plates, Belt, Condensed Milk |

| Chapter 41 | Raw hides & Skins, Leather |

| Chapter 42 | Trunks, Suit-cases, Vanity cases |

| Chapter 43 | Raw Fur Skins, Articles of apparel |

| Chapter 44 | Fuelwood, Wood Charcoal |

| Chapter 45 | Natural Cork, Shuttlecock Cork |

| Chapter 46 | Plaiting Materials, Basketwork |

| Chapter 47 | Mechanical & Chemical wood pulp |

| Chapter 48 | Newsprint, Uncoated paper & paperboard |

| Chapter 49 | Printed Books, Brochures, Newspapers |

| Chapter 50 | Silk Worm Cocoon, Yarn, Waste & Woven Fabrics |

| Chapter 51 | Wool materials & Waste, Animal Hairs |

| Chapter 52 | Cotton materials, Synthetics & Woven fabrics |

| Chapter 53 | Flex raw, Vegetable materials & Paper yarn |

| Chapter 54 | Synthetic filaments, Woven fabrics & Rayons |

| Chapter 55 | Synthetic filament tows & Polyester staple fiber |

| Chapter 56 | Towels, Napkins, ropes & Netting materials |

| Chapter 57 | Carpets & Floorcoverings textile Handlooms |

| Chapter 58 | Labels, Badges, Woven pile & Channel, Terry towelings |

| Chapter 59 | Rubberized textile fabrics, Conveyer belts |

| Chapter 60 | Pile, Wrap Knit, Tarry & Crocheted fabrics |

| Chapter 61 | Men & Women Clothing |

| Chapter 62 | Men & Women Jackets, Coats & Garments |

| Chapter 63 | Blankets & Bedsheets |

| Chapter 64 | Shoes & Footwear Products |

| Chapter 65 | Hats & Accessories |

| Chapter 66 | Umbrellas & Accessories |

| Chapter 67 | Artificial flowers, Wigs & False Beards |

| Chapter 68 | Monumental & Building Stones |

| Chapter 69 | Bricks, Blocks & Ceramics |

| Chapter 70 | Glasses, Mirrors, Flasks |

| Chapter 71 | Pearls, Diamonds, Gold, Platinum |

| Chapter 72 | Iron, Alloys, Scrap & Granules |

| Chapter 73 | Iron tube, piles & Sheets |

| Chapter 74 | Copper Mattes, Rods, Bars, Wires, Plates |

| Chapter 75 | Nickel Mattes & Unwrought Nickel |

| Chapter 76 | Unwrought Aluminium- Rods, Sheets & Profiles |

| Chapter 78 | Unwrought Lead – Rods, Sheets & Profiles |

| Chapter 79 | Unwrought Zinc – Rods, Sheets & Profiles |

| Chapter 80 | Unwrought Tin – Rods, Sheets & Profiles |

| Chapter 81 | Magnesium, Cobalt, Tungsten Articles |

| Chapter 82 | Hand Tools & Cutlery |

| Chapter 83 | Locks, Metal Mountings & Fittings |

| Chapter 84 | Industrial Machinery |

| Chapter 85 | Electrical Parts & Electronics |

| Chapter 86 | Railway Locomotives & Parts |

| Chapter 87 | Tractors & Motor Vehicles |

| Chapter 88 | Balloons, Parachutes & Airlift Gear |

| Chapter 89 | Cruise Ships & Boats |

| Chapter 90 | Medical, Chemical & Astronomy |

| Chapter 91 | Watches & Clocks |

| Chapter 92 | Musical Instruments |

| Chapter 93 | Military Weapons & firearms |

| Chapter 94 | Furniture, Bedding & lighting |

| Chapter 95 | Children Toys, Table & Board Games & Sports Goods |

| Chapter 96 | Pencil Lighter Toiletries |

| Chapter 97 | Paintings Decoratives Sculptures |

| Chapter 98 | Machinery Lab Chemicals Drugs Medicines |

Search GST HSN Code List

The process to search GST HSN code is given below.

Step 1: Visit Goods and Services Tax official website https://www.gst.gov.in.

Step 2: At the home page, go to the services category and click “Search HSN Code“.

Step 3: Direct Link https://services.gst.gov.in/services/searchhsnsac.

Step 4: Enter HSN Chapter by Name or Code and Click on the “Search” button then HSN Code will open.

| Author | CBITC |

| Language | English |

| No. of Pages | 438 |

| PDF Size | 1.42 MB |

| Category | Government |

| Source/ Credits | taxindiaonline.com |

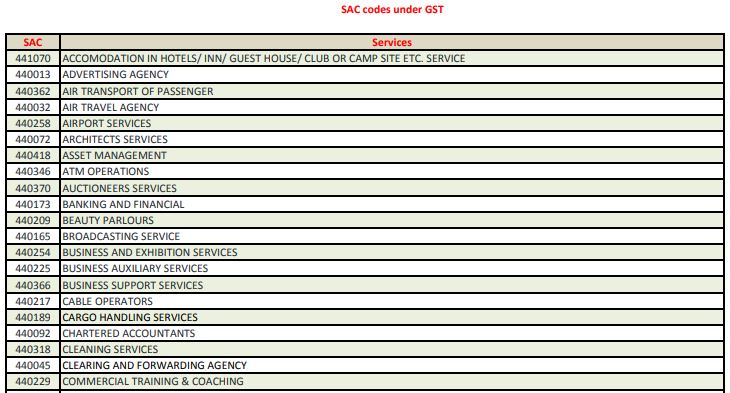

Also download the SAC code and HSN list PDF From Here, Click

GST HSN & SAC Code List PDF Free Download