‘Axis Bank Sukanya Samriddhi Account Form’ PDF Quick download link is given at the bottom of this article. You can see the PDF demo, size of the PDF, page numbers, and direct download Free PDF of ‘Axis Bank Sukanya Samriddhi Account Form’ using the download button.

Axis Bank Sukanya Samriddhi Account Form PDF Free Download

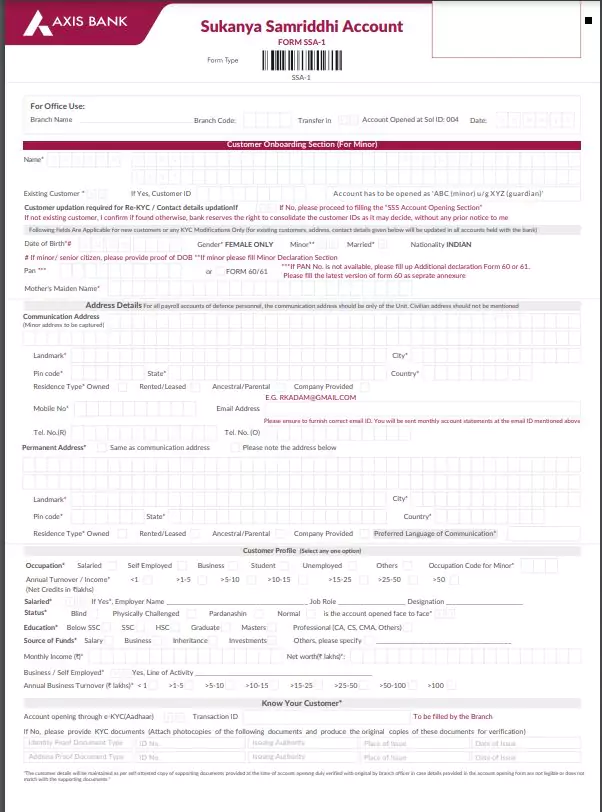

Axis Bank Sukanya Samriddhi Account Form

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme, specially launched for the welfare of the girl child across the country.

With guaranteed interest income and tax exemption, this scheme is a win-win decision for the parent or legal guardian of the girl child; The funds received from Sukanya can later be used for the higher education and/or marriage of the girl child and to secure her financial future.

The account can be opened in the name of a girl child below 18 years of age by her parent/legal guardian. This account can be opened in any nearest Axis Bank branch.

Key Features of Axis Sukanya Samriddhi Account

Account opening: SSY account opening is permitted only for Indian resident parents or legal guardians; A maximum of two accounts can be opened for two girl children in a family. However, in the case of triplets in the first birth or twin girls in the second birth after the first girl child, the third girl child may be considered.

Tenure: An SSY account requires 21 years to mature or till the girl child gets married after the age of 18 years. The account can be kept active for a maximum period of 21 years from the date of opening of the account. Once this period is over, the Axis Sukanya Samriddhi Account does not earn any interest.

Age Criteria – The account can be opened till the girl child attains the age of 10 years.

Deposit Criteria – Sukanya Samriddhi Yojana in Axis Bank can be opened with an initial deposit starting from as low as Rs. 250 per annum and the maximum deposit amount goes up to Rs 1.5 lakh in a year. Axis SSY deposit can be made through cash and/or cheque. Deposits can be made in the account till the completion of a period of 15 years from the date of opening of the account.

Eligibility Criteria: The scheme is valid only for the residents of India. Female children with NRI status will not be allowed to open an SSY account. However, if after account opening, the account holder attains NRI status, his/her parent/legal guardian has to inform about this change within 1 month to the concerned Axis Bank branch on the basis of which the account is opened will be closed.

Partial Withdrawal – 50% withdrawal is allowed from the Axis Sukanya Samriddhi Account when the girl child reaches the age of 18 years. This fund can be used for the purpose of higher education/marriage of the girl child.

Account Activation: A minimum deposit of Rs. 250 per year is required for at least 15 years to ensure the continuity of the account. The account becomes inactive if the minimum deposit of Rs 250 is not made in a year. However, it can be revived by paying a penalty fee of Rs 50 for the defaulted years a minimum annual deposit of Rs 250 per year for the defaulted years, and Rs 250 for the current year in which it is being activated. ,

How to open a Sukanya Samriddhi Yojana account in Axis Bank?

Axis Bank provides a quick and hassle-free way of opening an SSY account. Individuals without an Axis Bank account can also open an SSY account by submitting the following documents:

Axis Bank Sukanya Samriddhi Yojana Account – Documents Required

- Girl child’s birth certificate

- Photo ID of parents or legal guardian

- Photograph of the child and parent (applicant)

| Language | English |

| No. of Pages | 4 |

| PDF Size | 0.07 MB |

| Category | Bank |

| Source/Credits | – |

Related PDFs

YSR Pension Kanuka Application Form PDF Telugu

Assam Education Loan Application Form PDF

Axis Bank Current and Savings Account Opening Form for Non-Individuals PDF

Assam Birth Certificate Application Form PDF

Odisha Disability Scholarship Application Form PDF

Axis Bank Sukanya Samriddhi Account Form PDF Free Download